We started drafting this post as a beginner-level explanation of how dispatch works in the NEM for several reasons, including the following:

Prime Reason = for our clients) Because of the influx of new entrants to the generation side of the NEM (most often on the back of Semi-Scheduled solar and/or wind projects) we have welcomed on board a number of new clients to our ez2view software suite in recent months.

The onboarding process with these clients has involved a full day training session focused on how dispatch works, and hence how prices are set in the NEM. In delivering this training, we team up with one of a number of consultants we work closely with (some noted below), as they can help to fill in our gaps in knowledge, and explain things well.

With this background, that these new clients can increase the value they gain from their licences to ez2view.

The one-on-one training processes are very beneficial, but also time-consuming. Hence we will be augmenting this content with other content posted on WattClarity.

Secondary Reason = for other readers) Whilst the prime focus is for onboarding our new clients (particularly new entrants to the generation sector – some of whom don’t have much background in the way dispatch actually works) it is likely that other readers will also find the content useful.

There’s much been said recently about generator bidding in the market- including about a (often very vaguely defined “gaming the market”). This content might help interested stakeholders in that discussion understand some context to better form their own views of what’s happening.

With that in mind, we hope you will find the following useful:

(A) Different approaches to generator offers (or “bids”)

Also today we have posted this explanation of different approaches to dispatch, to provide some context to the marginal price based dispatch approach used in the NEM.

(B) A market that is “Energy Only” and a “Gross Pool”

At some later point I will explain more about how the NEM is what is described as both “Energy Only” and “Gross Pool”.

(C) Beginner Level understanding of the dispatch process

In this post we’ll start very simple, and (walking through 5 “dispatch intervals”) will progressively make it slightly more complex.

Taken together this post should be viewed as just “Beginner Level” understanding. The more complex parts of the process (and there are many) will be left to subsequent posts, as time permits.

In starting here, we make a whole swag of simplifying assumptions – including a number specifically highlighted here for future reference:

| Unified Dispatch/Trading Interval, lasting an hour | Unlike the NEM (which has 5-minute dispatch and 30-minute settlement until 1st July 2021) we assume that the Dispatch and Trading Interval are the same length.

To simplify the maths further, we assume that this interval is a whole hour to avoid distracting confusion about the difference between rates (in MW) and volumes (in MWh) as discussed here. |

| Simplified regions | For the first three intervals in this post, we assume a single pricing region and only three generators. Even when we expand this, we keep it to two regions – hence much simpler than the NEM structure. |

| Discrete intervals | In the real world, there is overlap between the processes that occur with respect to sequential intervals. In this post we deliberately overlook these. |

| No losses | We assume there are no losses in this network. |

| Only one transmission constraint | Not until interval 5 do we introduce a measure of congestion, and even then, we keep it simple. |

| No ramp rate consideration | We’re assuming infinite ramp rates, and no other constraints on generation output (apart from capacity offered into the market). |

| Single tranches | We assume that each generator only bids a single tranche of volume. |

| All Fully Scheduled | No consideration is given to the special intricacies of operations of Semi-Scheduled capacity. |

| No (co-optimisation of) Frequency Control | In the NEM there are 9 commodity markets, all co-optimised for each dispatch interval. In this very simplified assumption, we deliberately leave out consideration of co-optimisation of the 8 x FCAS commodities. |

Even with these simplifying assumptions, our experience suggests that the following concepts are not as widely understood as they perhaps should be. We’re interested to hear from our readers about the extent to which the following five intervals helps them?

Interval #1 (a Single Region, low demand)

Through this animation of Interval #1, we see a situation whereby a single generator is called on to supply all of the demand for that region/market. This generator (being the only one dispatched) is paid what it bid (in $/MWh) to supply the required volume of energy (in MWh) over the interval.

Key take-away #1

The Demand Side of this market does not actually bid to consume.

Rather, because all of this happens instantaneously, a “single buyer” (in our case the AEMO for the NEM) forecasts the aggregate demand at the end of that interval and uses this to dispatch the supply side at lowest cost.

Proceeding into Interval #2 below, we see that the demand has grown such that it exceeds the capacity of the generator that’s bid the lowest price. In this case, the second generator in the bid stack also needs to be called on to dispatch:

Interval #2 (a Single Region, moderate demand)

Key take-away #2

In this case, it’s important to note that all generators in the region are paid the same marginal price if they are called on to dispatch any of their available capacity during that period. That’s because the market is not “pay as bid”, and so the generators bid lower accordingly.

Proceeding onto Interval #3 we assume the demand has grown higher still, requiring all three generators to dispatch:

Interval #3 (a Single Region, high demand)

Like the two prior intervals, it is the highest-priced bid called on to dispatch that sets the market clearing price, which is paid to all volume dispatched in this market.

Moving into Interval #4 we introduce a second region, with an interconnection of limited capacity in between the two regions:

Interval #4 (Two Regions, unconstrained flow)

We see, in the animation, that (at least in the first instance) the demand for each region is stacked together and the dispatch algorithm solves for the Objective Function of “lowest total cost to supply all of this demand”.

In this case, the transfer over the interconnector is 50MW towards the south, which is below the 100MW limit of capacity on the line and so it is said that “the interconnector is unconstrained” or that “the interconnector is not flowing at a limit”.

Key take-away #3

It’s important to note that the price paid to generators in the region offering the cheaper generation is higher than would be the case if the interconnection did not exist in this case. In the animation above, this is Region A, which could have supplied its own demand fully with supply from Generator B (at only $15/MWh).

Novices sometimes point at instances like these and conclude that the region would be better off without the interconnector. However, this overlooks the many other benefits that are gained from broader interconnection.

Moving into the final interval in this post, we see a case whereby the interconnector is “maxed out” and, as a result, prices separate between regions:

Interval #5 (Two Regions, constrained flow)

For the pedantic and knowledgeable reader here, note that there are some simplifying assumptions made in apportioning the “Demand” column like we have done. We won’t go into this today…

In this interval, the dispatch engine would like to dispatch more of the (less expensive) Gen A capacity to meet that last 50MW of demand in region B. However, there’s not enough space in the transmission line to fit the transfer, hence it is noted as being “constrained” or “flowing at a limit”.

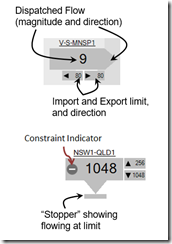

In our software we adopt two different methods of signifying interconnectors being constrained:

| NEMwatch™ v10 and deSide® | ez2view™ v7 |

| In these two applications, we colour the interconnection red when the flow is running at a limit:

During unconstrained flow, we colour the interconnector black: |

In our higher end dashboard ez2view, we use colour to denote other things, hence show an interconnection running at a limit by including a “stopper” on the end: |

| Across each of these products, and in others, we also provide visibility of the limits of flow either way on these lines. In the real world these are dynamic, rather than the simple static representations here. | |

Speaking of software for the real world, it’s important to note that the NEM currently has 5 regions (there were 6 regions for a few years after Tasmania joined and up until the abolition of the Snowy Region, hence covered in versions up to and including NEMwatch v7).

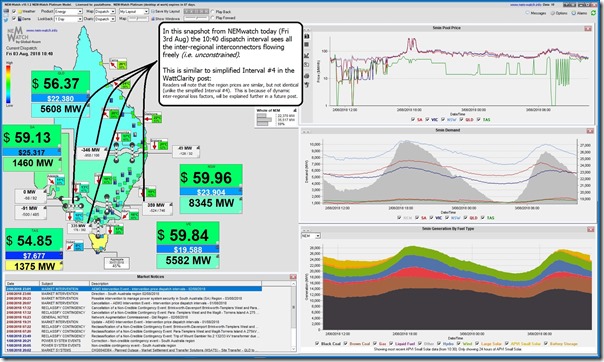

Here’s one snapshot from our popular NEMwatch v10 dashboard that illustrates the 5 regions, and interconnections between each:

Note that the prices are not identical between any of the regions, even when the interconnectors are not constrained. In a follow-up post, we’ll drill in further to explain why this is the case.

Key take-away #4

When interconnectors are unconstrained, the dispatch process incorporates available supply from all regions and hence, via increased competitive tension, ensures that the price outcomes are as low as possible.

When an interconnector is constrained, separate “Economic Islands”* are formed and prices separate.

Under this scenario the price in one region will be marginally lower than it would otherwise be – however the price in the other region (i.e. the one unable to access more lower-cost generation) will be substantially higher, sometimes astronomically higher as the cessation of competitive tension enables remaining generator(s) to extract monopoly rent.

* Two “Economic Islands” are formed when two groups of regions are economically (though not necessarily physically) separated across a constrained interconnector, meaning that there are different sets of marginal bids in each Economic Island – hence separate prices.

We’ve been using the term “Economic Island” since 2006 on WattClarity and specifically include special recognition in NEM-Watch v10 of them because of their significance in terms of the separation of prices between regions (and local generator market power).

We hope that it is obvious that, with the NEM being 5 regions interconnected together, the dispatch process is more complicated than our simplified 2-region model illustrated in the fictitious intervals above.

(D) Progressing beyond Beginner Level

As time permits, we will be seeking to expand on these explainers under the Energy Literacy section of WattClarity – to augment the one-on-one training provided to our the new entrant generators coming onboard with ez2view, and more generally as an attempt to help tame Villain #4.

PS on 28th February 2019

| As part of the process of preparing our Generator Report Card 2018 for publication, we invested considerable time in analysis of AEMO’s Price Setter data. In conjunction with this, we posted this (preliminary) Intermediate Guide to follow on from this Beginner’s Guide.

We trust you will find this of some use. |

However please note that WattClarity® is our “spare time” job, and that animations like the above take a fair bit of time and effort to put together. Hence, we ask for your patience whilst waiting for subsequent efforts.

(E) For one-on-one assistance

If you need one-on-one assistance in understanding more about the NEM, we would highly recommend either of the following two people. We utilise their services heavily, and are sure you will gain great value from them (though note that any stupid mistakes in the preparing the above Beginner’s Guide are entirely mine).

| Allan O’Neil | Jonathon Dyson |

Allan has been a guest author on WattClarity for several years now. His detailed analysis of some particularly volatile periods has been of great value to our readers (as many have noted to me). In parallel with this work, Allan has been involved with us in helping to deliver training to new clients coming onboard with ez2view – and has assisted us internally on other projects. Allan has also begun providing an on-site educational service covering how spot prices are set in the NEM, and other important aspects of the physical electricity market. Further details about “NEM Powered Training” are here. |

Jonathon has also been a guest author on WattClarity, though a more sporadic one. We have utilised Jonathon’s services in several ways over many years. Jon has also been involved with us in helping to deliver training to new clients coming onboard with ez2view. |

Similarly, if you know of other specific people who are excellent at both understanding the nuances of the dispatch process and explaining these to others, could you please point them our way?

Until next time, I hope this has helped?

A few more novice questions, which I hope are addressed in future issues.

1. Why are interconnectors between regions constrained to half or less of their thermal capacities, whereas within regions there don’t seem to be problems using transmission lines up to their thermal capacities? In other words, does physics work differently between States than within States?

2. Why are interconnectors often constrained to well below half of their thermal capacity?

3. Why are there now system strength requirements requiring a minimum number of gas generators to be on-line at all times in South Australia, whereas in the recent past it seemed to operate without problems without these system strength requirements? For example, for several hours on 13 November 2016 there was only a single gas generator operating in South Australia, with all electricity generated from wind, and there didn’t seem to be any problems reported.

4. In determining the system strength requirements in South Australia, why have none of the simulations to date have included the 70MW of battery capacity from Hornsdale Power Reserve to include it within the minimum system requirements.

5. In the Victorian market, why would the brown coal bids be so low that night-time spot prices drop as low as $11/MWh, and at this price none of the generators are at minimum operating load? Surely it would be in their interests to put in higher bids down to the minimum operating load.

Thanks Malcolm. Will get to these in the future “Intermediate Level” posts.

Hi team, I love all your articles, despite not always understanding 100% of the terminology. I was wondering, is there any tool available, that a casual observer like myself could see live bids into the NEM for wholesale prices? I’d be curious to see for example: “Eraring – Black Coal – 5MW @ $120 / MWh”, and every other generator listed out with the same detail. I’m sure it’s probably a dumb question, and it’s probably nowhere near that simple, but if such a tool does exist, i’d love to use it! I’m eyeing off your “Nemreview” tool’s website, and thought perhaps this is where you get all your fantastic info from.

Thanks in Advance!