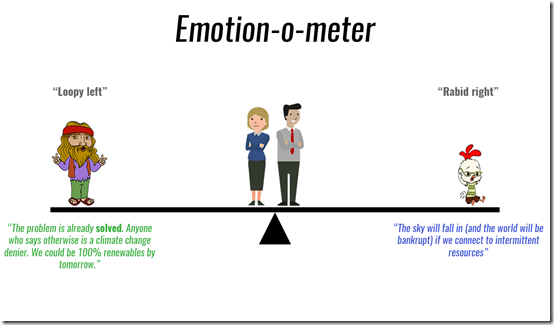

There sure are a diverse bunch of views apparent across the large and growing number of active stakeholders in the Australian electricity supply industry – ranging from the far, far right down to the far, far left, with a wide range of shades in between:

That’s going to make it very difficult, indeed, to arrive at a long-term, politically-sustainable framework for undertaking this broad-ranging energy-sector transition.

Leave a comment