1) The Significance of the CPT

For only the third occasion in the 10 1/2 years that the NEM has been operational, the Cumulative Price Threshold (CPT) has been reached. Yesterday evening, the CPT was reached in the Tasmanian region.

(a) What is the CPT?

The Cumulative Price Threshold is like a safety valve for the market – if pricing gets too hot, for too long (and the CPT is reached) then prices are capped for a period of time to allow the market to cool off. In essence, this will help to ensure no market participant goes bust by virtue of excessive volatility.

The Cumulative Price (for a region) is a rolling total of the most recent 7 days of trading prices for that region (i.e. 7 x 48 = 336 trading intervals).

The Cumulative Price Threshold is currently set at $150,000/MWh (i.e. 15 times the current level of VOLL, or Value of Lost Load).

When the Cumulative Price reaches the CPT, the price (in the offending region) is capped at $300/MWh for a period of time.

(b) Sequence of Events

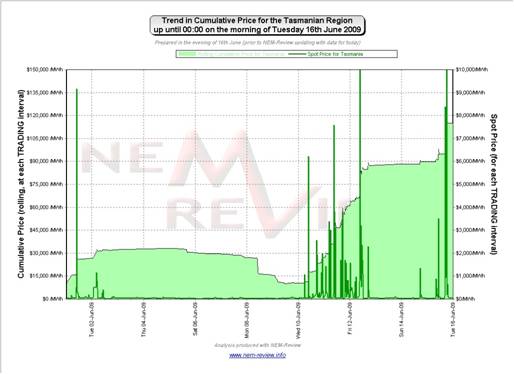

The following chart (generated with the NEM-Review software) provides a view of how the Cumulative Price in Tasmania had trended through June, up until midnight this morning (16thJune).

The early days shown in the chart indicate more “typical” levels of Cumulative Price – prior to the volatility we started to see on Wednesday 10th June.

As we can see from this chart, the volatility caused the Cumulative Price to escalate sharply, to the point where it was at $115,000/MWh leading into Tuesday morning (16th June).

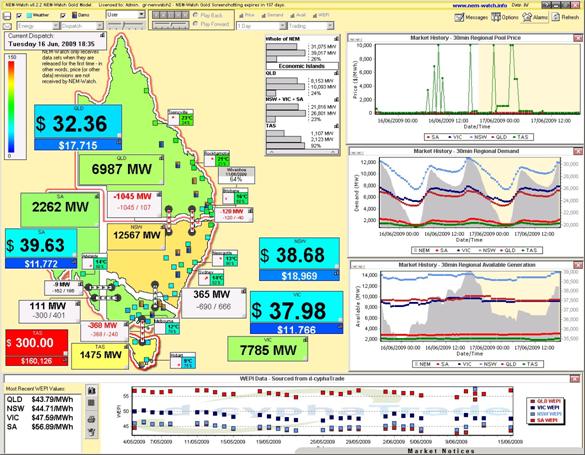

The following snapshots from NEM-Watch illustrate some of that which happened throughout the day on Tuesday 16th June:

As shown above, pricing in Tasmania hit VOLL for the first time very early (at 06:55 this morning) – at which time we can see that the low temperatures in the state (3°C in Hobart) caused the region to climb to a relatively high level of demand, as shown in the yellowish colour for the region.

The “current” Cumulative Price in the region is shown in the price box, under the spot price for Tasmania – as we outlined in the email we sent to clients on 8th May, to mark the release of NEM-Watch version 8.2

At 09:20 this morning, we see (above) that the Cumulative Price had climbed further (to $125,000/MWh).

As shown in the chart for Basslink, the interconnector had been running at maximum capacity south for much of the morning, and that there had been a number of instances where there had been a significant price difference between the TAS and VIC region (i.e. as the TAS price jumped to VOLL).

In the NEM-Watch snapshot below (taken at 17:00) we see that there were 4 separate occasions during the morning when the price spiked to VOLL, and one in the evening (as shown). It was this instance of VOLL pricing that forced the rolling Cumulative Price to reach the CPT (as shown in NEM-Watch).

At this point, NEMMCO published a Market Notice, which was captured in a Local Alarm we had set up on a display copy of NEM-Watch we have running continuously in the office – as shown here:

As a result of this CPT being reached, we see in subsequent dispatch intervals the TAS price not exceeding $300/MWh – such as below at 18:35):

On another topic, we see that the NEM-Wide demand had risen to 31,075MW at this point in the evening – which we would expect will be well below what will be the peak NEM-wide demand this winter. As can be seen through the colour-coding, only demand in NSW and TAS were moderately high.

Can you predict the peak demand this winter in our “Best Demand Forecaster” competition?

Whilst the CPT provision has been in the rules since NEM-start, it has only been called upon in two previous instances (discussed below). As such, we are still learning the implications of what this means for the market. For instance, depending on the nature of transmission flows over Basslink, this may also mean a cap on prices in the VIC region (and further away, as well) for as long as the price cap is in place.

Because the first instances of volatility were experienced on Wednesday 10th June, we can expect to see the Cumulative Price backing off rapidly – beginning tomorrow, and then through to Friday.

2) Other Instances when CPT reached

On (only) these two other occasions has the CPT been reached in any region, across the NEM, though there have been a couple of other “close shaves”:

(a) March 2008 (South Australia)

Back in March 2008, South Australians were forced to endure 15 straight days of extreme temperatures (yes, Victorians copped it a bit, as well).

As a result of these extreme temperatures (and with the assistance of some generator bidding practices aimed at profit maximisation) we saw the Cumulative Price Threshold reached in the NEM for the first time – in the South Australian region.

We published some analysis of South Australia’s Cumulative Price Threshold event of March 2008 towards the end of that month.

(b) February 2009 (Victoria & SA)

Earlier this year, extreme temperatures across South Australia and Victoria again caused demand to skyrocket (a new record NEM-wide demand was set, smashing previous summer records), leading to prices jumping and the CPT being reached in both regions.

We published some analysis of the Cumulative Price Threshold event of 29th January 2009 (very) late that evening.

th.jpg)

th.jpg)

th.jpg)

PS – a couple of our friends at NEMMCO have pointed out a couple of things following from this article:

1) Technically, this is the 4th time the CPT has been reached (as both SA and VIC reached the CPT as a result of the heatwave this summer – as we noted here)

2) NEMMCO has provided this briefing paper on the Operation of Administered Pricing in the NEM – amongst other things, it clarifies how the pricing in other regions can be affected, due to the operation of the interconnectors. For instance, in the case above, prices in VIC could be affected because of flows over Basslink, meaning VIC also experiences a defacto cap, in some scenarios.

3) NEMMCO has also noted (with reference to this Power System Operating Procedure) that they remove the cap if the following logic holds:

If NEMMCO has applied the APC and at the end of that business day, for Trading Interval 0400 hrs, the Cumulative Price is;

< CPT, then NEMMCO will not continue the application of the APC

> CPT, then NEMMCO will continue with the application of the APC

If at the Trading Interval 0400 hrs the Cumulative Price is less than the Cumulative Price Threshold, it is of NEMMCO’s opinion that determination of the price exceeding the Cumulative Price Threshold during the next trading day cannot be accurately predicted due to market volatility and as such will not be utilising NER 3.14.2 (c) (3). However, NEMMCO will exercise this option under the appropriate circumstances.

Hope this helps!