It’s getting late today, but I really have to post this now in order to get back to other commitments in the morning. Hence I do apologise for any lack of clarity (or ideas not fully thought through) – and, of course, mistakes – in the following…

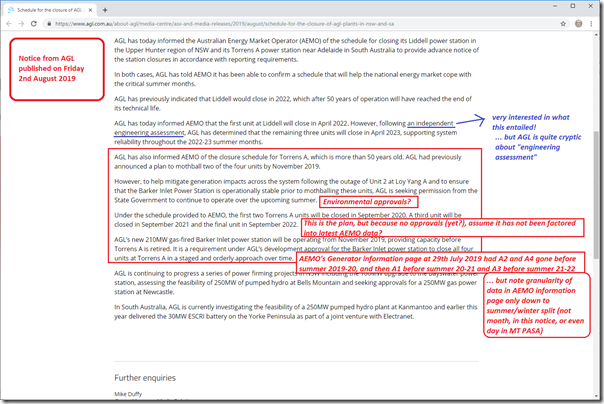

Last week on Friday 2nd August (ironically in the same week as the CEC’s Clean Energy Summit on Tuesday/Wednesday) we noted the decision made by AGL Energy:

- to slightly extend the operations of the Liddell Power Station (coal-fired) in NSW past the previously noted retirement date of 2022 (for three units into 2023); and also

- to delay the closure of Torrens A (gas-fired) station in South Australia until after summer 2019-20.

This was noted in this announcement to the ASX and media by the company – and then picked up and discussed on that day in various news media outlets (including Angela Macdonald-Smith in the AFR, Perry Williams and Olivia Caisley in the Australian, by Fergus Hunter and Peter Hannam in the SMH/Age, and by Michael Mazengarb and Sophie Vorrath on RenewEconomy).

(A) Vision clouded by the #coalfail meme?

Sadly, what I observed via social media following the AGL announcement seemed be to almost automated reactions conditioned to occur following the long, concerted and vocal campaign under the #coalfail meme.

Some of the responses (which are not worth linking to here, as they would just compound the distraction) seemed to imply that because both plants are old, and hence implicitly unreliable because of age, extending their operations over summer 2019-20 (Torrens A) and summer 2022-23 (Liddell) might actually make the situation worse than it would otherwise be if the extension decisions had not been made. These reactions were most prolific (from what I saw) in relation to the decision at Liddell – which is I presume at least in part because it’s coal and not gas, and was a core focus of the stoush between (former CEO) Andy Vesey and the federal government back at the time of the initial closure announcement.

These reactions seem to me to be just another symptom of what I noted last year as a general malaise of “not focusing on the real problems” (Villain no5) – at least in part because of the yawning gap in our energy literacy (Villain no4).

Given the thinking space afforded by our focused efforts with respect to the Generator Report Card, we were able to expand on this thinking inside the report card with a broader/deeper observation that the “Transitional challenges require greatly enhanced analytical capability” – so much so that we explicitly discuss this observation over several pages at Theme 14 within Part 2 of the Report itself:

As time permits I will post more separately about the aspects of the “dependability” of the Liddell power station itself, sourcing data compiled for our Generator Report Card. However I stress that there seem to be more pressing questions currently than exploring #coalfail in relation to Liddell.

(B) More important observations/questions … in my view

Since the AGL announcement there have been a number of questions buzzing around in my head – so, in between other commitments, I’ve been trying to puzzle through – so I will try to outline some of these below (with more to come as time permits)…

Q1) What’s the underlying reasoning behind the brief extensions?

It’s important to keep in mind that the AGL notice pertained to two different stations and two different timeframes (though this might be crowded out if you just tuned into the push-back against Liddell extension).

The AGL release was not long on detail, so I have annotated this with a few comments below:

As both closures are real-life examples we should be learning from in terms of charting the broader energy transition (phasing legacy assets out, and new assets in), it seems to me that we should be seeking to understand as much as we can about what’s going on in this live-line experiment.

Q2) What’s the story for summer 2019-20?

There are a few moving parts with respect to summer 2019-20, a number of which fall into the AGL portfolio (which is a story in and of itself, in terms of accessibility of information):

Moving Part #1 = we have the decision above to ask for – though not yet confirm – a delay to the scheduled closure of the Torrens A units to beef up dispatchable capacity available in the South Australian region.

Moving Part #2 = we have the linked commissioning of the (somewhat replacement) Barkers Inlet station in South Australia in the same vicinity.

Moving Part #3 = we have the very significant extended outage at Loy Yang A2 in the Latrobe Valley in Victoria:

3a) I posted an initial note about this here in June after an AGL notice to the ASX and then Allan O’Neil followed up with more details on 14th June.

3b) Given the significance of the asset to AGL, the fact that there has not been any further update since that time leads me to presume that there are people at AGL running around quite stressed at the moment, trying to work out how they can possibly repair the unit in the shortest possible time (by repairing the existing generator, beg/borrow/buy another existing generator from somewhere else around the world, or manufacturing a new one (hopefully unnecessary, as it might take years to secure a slot, overcome technical issues with the manufacturer effectively not existing anymore and so on)) – my sense is that “no news means bad news”

Moving Part #4 = we also have the extended outage at Mortlake unit 2 close to the VIC-SA border – which I posted about on 9th July and then Allan O’Neil followed up with more on 23rd July.

Given that we’re now into August, this means only a few months away from summer-induced demand peaks (and high-temperature limitations on almost all types of electrical assets (including significant effect on some wind farms!), hence I would expect that there will be people at the AEMO who’d be getting nervous about all of this and contemplating pulling the trigger on mechanisms like the Reserve Trader – which was in place for summer 2017-18 (though not used) and summer 2018-19 (and used on January 24th and 25th 2019).

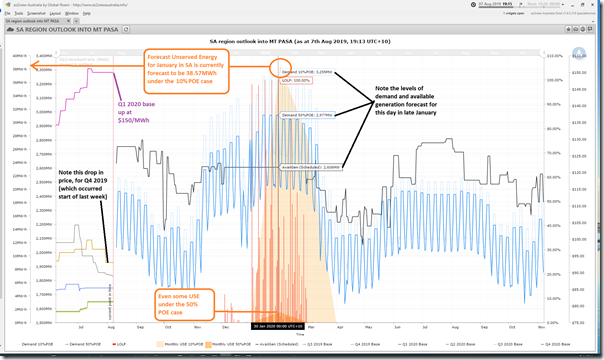

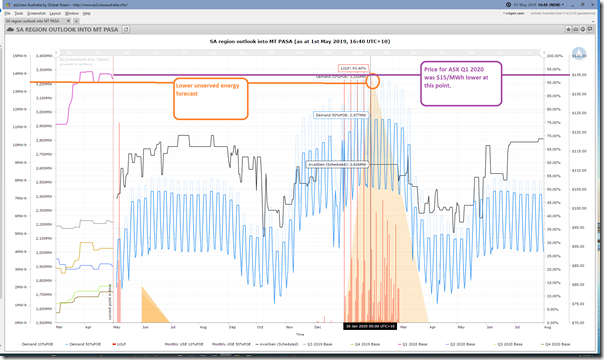

Using our ez2view software (including the Time-Travel functionality) I have tried to piece together some view of what’s been happening in the broader SA region, both in terms of visibility of prices of ASX futures (Base for SA) and also what the AEMO is saying in MT PASA focused on the coming summer.

Here’s a view from earlier this afternoon:

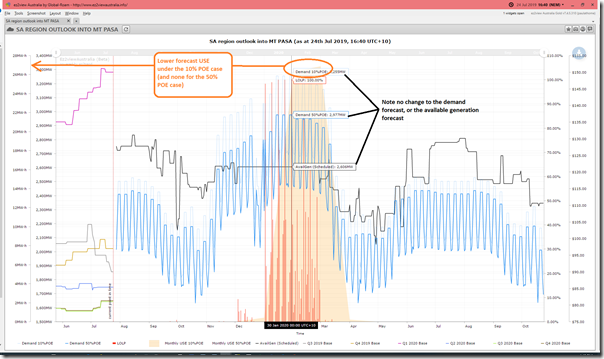

Here’s the same chart (showing exactly the same data series) time-travelled back 2 weeks (to 24th July, so before the 29th update of the Generator Information Page shown below, and before the AGL announcement on 2nd August).

Note no change in the forecasts for demand or available generation in the SA region (and yet we see that the level of Unserved Energy forecast for the month of January 2020 has grown in between this earlier update and the one (further above) 2 weeks later on 7th August).

Tracking further back (to 1st May) we see that the forecasts for available generation and demand have been quite stable – and yet back then there was much less Unserved Energy forecast back then (and the futures price for Q1 2020 was understandably lower).

This helps to highlight that AEMO’s expectations of unserved energy in the South Australian region are increasing (now even under a 50% POE scenario) – even though assumptions about demand and supply in the region have not changed. Hence this suggests either/both:

(a) something happening in neighbouring VIC, or further; or/and

(b) something different coming out of the Monte-Carlo model.

Q3) What’s the story for summer 2022-23?

Into the AEMO mix also throw the annual update to the Electricity Statement of Opportunities for 2019, due in the next couple weeks – which I expect will contain some white-knuckle periods in the forecast horizon (and possibly also call into action the Retailer Reliability Obligation).

In that framework, I am very curious about the “independent engineering assessment” AGL talks about in their notice. Those three words could be inferred as meaning pretty much anything, but I do have a few specific questions:

Q3a) What happened to the replacement capacity that Vesey was so public about?

In the very public stoush of a couple years ago, Andy Vesey was quite vocal about sufficient replacement plant being in place in time for Liddell to retire in 2022:

(a) What happened to that – is it merely delayed (by how long?) or is something larger at work?

(b) Was the “Vesey the Salesman” over-optimistic on what would be done by when, with the remaining people now at AGL a little more realistic about what could be done and by when?

Q3b) Heaven forbid, there’s no risk of Loy Yang A2 being out that long?

The horrid thought did occur to me (and perhaps to others as well) that part of the thinking might pertain to a risk that AGL need to contract to build a new generator to replace the damage one, with some difficulty in obtaining a slot at GE or somewhere else, and a suitable design (given the age of the unit, and the fact that Brown-Boveri does not exist anymore).

In the absence of any update from AGL, I wonder who else has had that horrid thought…

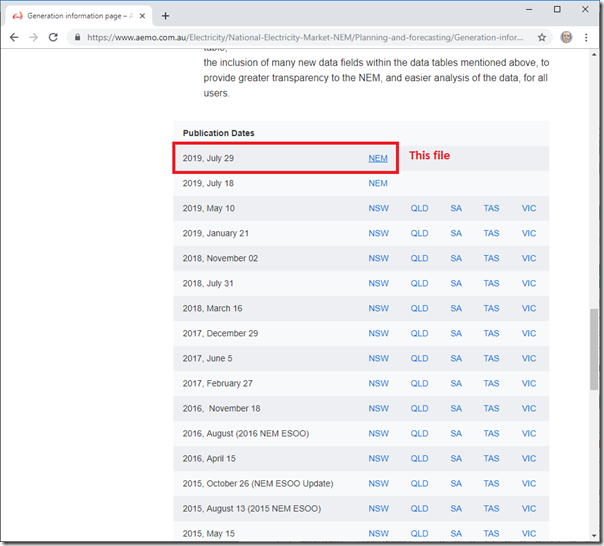

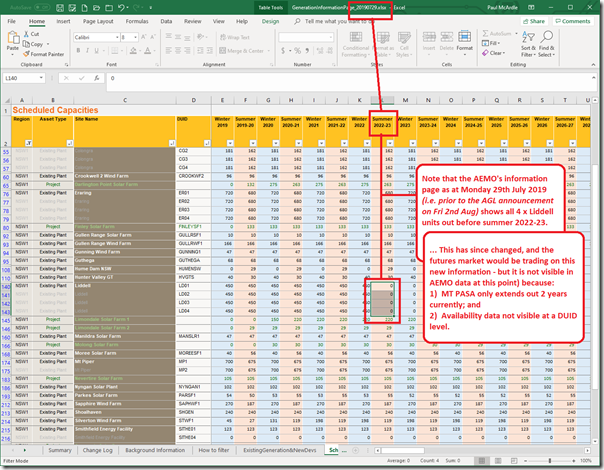

Now AEMO’s MT PASA window currently only extends out 2 years into the future, and generator availability is only published on an aggregated-to-region basis currently.

Hence the only AEMO resource I know of that can be somewhat useful at the current point (until the ESOO comes out, and then that is only annual anyway) is this Generator Information Page. However you’ll note that the most recent update there currently is one from Monday last week (i.e. 29th July before the AGL announcement):

Hence it is understandable here that the XLSX file provided still shows the schedule at the time that Liddell was to be closed before summer 2022-23:

No update, in this file (which was published before the AGL announcement) to reflect the longer run time – and also no update about Torrens A and Barkers Inlet (and that file still showed the assumption that Loy Yang A2 would be back by summer 2019-20).

How MT PASA evolves (and the ASX contract pricing with it) in the next few weeks will be of considerable interest….

(C) We can do better, in terms of visibility – we need to!

At this point I am running out of time this evening, but wanted to note that the ASX Futures Contracts (out to Q2 2023) will have traded since AGL’s announcement last Friday and yet (to my knowledge – please let me know if I am wrong!) there is no corresponding AEMO information published about the physical market that maps to the markets consensus expectations of what the Liddell extensions (and whatever drove them!) mean in financial terms.

Almost in parallel with these current developments in the market, I’ve been aware of this Rule Change proposal submitted by ERM Power to improve the transparency and extend the duration of MT PASA. Sounds to me like an almost universally beneficial change (though of course we are already working through a significant backlog of information system changes following from Five Minute Settlement and so on).

Stay tuned for the publication of the ESOO in the next couple weeks (and, I expect, some form of triggering of the Retailer Reliability Obligation). This will make it even more important that we get better visibility into the future, which is:

1) Longer range (beyond 2 years)

2) More granular (down to the day, like in MT PASA)

3) Updated more frequently (every 3 hours, like in MT PASA availability); and

4) Showing visibility down to the DUID level.

Sorry I don’t have more to note this evening (and also apologies that this rushed article is not as coherent as I would like it to be).

Perhaps the longer testing periods required to before new generation can feed into the grid at full capacity have affected their decisions. AGL must be smarting from delays in allowing the Silverton wind farm to run at full capacity. Better to keep an old unit in reserve until the new capacity is fully commissioned.

The extension of 3 units of Liddell gives “cover” for decommisioning one unit early in 2022, which would presumably be the least reliable unit. This decomissioned unit can then be cannibalised for spares to keep the other units operating.

AGL’s results announcement on Thursday said re LYA2 “Work under way to return to service, expected mid-December 2019”. As this is material information in an ASX release you would have to assume it remains AGL’s best estimate for return date and would have been carefully vetted, probably ruling out worst case scenarios like manufacture of a new rotor or stator. Of course it doesn’t rule out risks of the return date slipping by weeks or even months. It will be fascinating to see how AEMO deals with delay risk in its ESOO update.