As highlighted in Paul McArdle’s initial post on this topic this week, an extended outage of unit 2 at AGL’s Loy Yang A power station has generated considerable interest in the media (conventional and social) and speculation about price and reliability implications for Victoria, extending into the early summer period.

This brief post examines what we can see in data published this week in AEMO’s medium term reliability outlook (“MTPASA”), and any impacts that knowledge of the outage has had on forward electricity prices for the second half of this year.

A little bit of history

Just before that, some might be wondering why such a long outage period is required to repair the electrical damage sustained by LYA unit 2’s generator. The complete answer to that question requires going back to the 1970’s and the history of the Newport (yes Newport) gas-fired power station, which was originally designed as a 1,000 MW station comprising two 500 MW units. The then State Electricity Commission of Victoria (SECV) had proceeded as far as ordering two turbine-generator units for Newport from their chosen suppliers (Alstom/Brown-Boveri) before their plans were derailed by concerns over metropolitan air quality impacts and an ultimate decision to downsize Newport to a single 500 MW station. This left the SECV with the problem of what to do with an extra 500 MW turbo-generator package for which the order could not be cancelled.

Someone in the SECV had the bright idea of installing Newport’s unwanted sibling generator at Loy Yang A power station which was then less advanced in design and construction, and reducing the planned order for that station of four 500 MW turbo-generators from proposed suppliers Siemens/Kraftwerk Union, to three. While this solved the SECV’s immediate problem of where to store an otherwise surplus-to-requirements multi-million dollar piece of equipment the size (and many times the mass) of a large bus, it bequeathed a number of headaches to the designers, operators and later owners of Loy Yang A, in running and maintaining two different types of turbo-generator unit in the one station.

This is particularly relevant when it comes to managing spare parts for very large and expensive pieces of kit like generators. These essentially comprise two very massive parts known as a stator (what you can see on the outside) and a rotor, the rotating part inside the generator, spun in the stator’s magnetic field by the power of the steam turbine to create electrical power.

In a multiple unit station, or group of stations, all using the same brand of generator, it is reasonable to carry a spare rotor and stator which can be used to replace a damaged component on any of the operating generators in the station or fleet. AGL does carry such spares for the generators in use on Loy Yang A units 1, 3 and 4. But doing this for a single generator of a different type – the situation for Loy Yang A2 – is much harder to justify and it appears AGL do not carry such spares for this unit.

As a result, the damaged stator and rotor at LYA2 can’t be “swapped out” for replacement with spares on hand (a big job anyway), but will have to be fully repaired before the unit can come back to service, potentially in early December.

Reliability Outlook

Back from the history lesson, what are AEMO and the forward market telling us about the impacts of the outage?

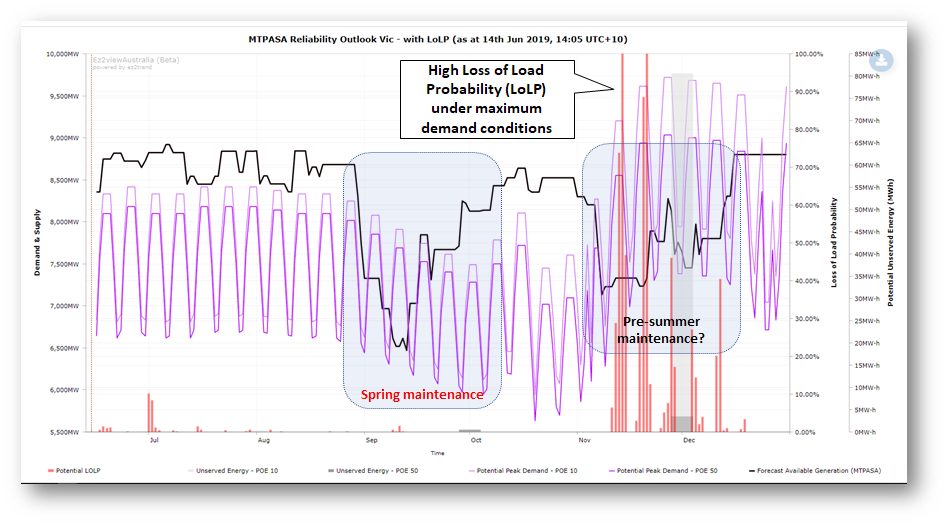

First, here’s an ez2view trend chart showing data from AEMO’s weekly MTPASA reliability run for Victoria, published later than usual this week to factor in the potential length of the LYA outage:

Purple lines on this chart show potential maximum daily demands (on 1-in-2 and 1-in-10 year bases) across the balance of this year, while the dark line is available dispatchable (scheduled) generation capacity – clearly obvious and highlighted are two periods in September- early October and November-early December where significant groups of outages are currently planned at other Victorian generators. The orange bars show AEMO’s assessed “Loss of Load Probability” metric under the assumption of maximum demand actually occurring at the relevant times, with this rising to high levels (up to 100%) during the November – early December period. This is driven by the higher potential demands as we move into summer, together with the previously discussed outages. I’ve previously discussed the basis for and interpretation of these reliability assessments in this earlier WattClarity article.

What’s not explicit on this chart is how much lower the risk of load shedding would be without the extended LYA2 outage. A hint of this can be gained from the change in LoLP values after the nadir in available capacity seen in mid-November. The capacity line steps up by about 500 MW (LYA2’s capacity), and despite higher potential demands as we move towards summer, LoLP values fall significantly in late November, before virtually disappearing the back half of December, at which time LYA2 is presumably assumed back in service in this analysis.

So we can probably broadly conclude that without the LYA2 outage, this assessment would be showing some LoLP in the depth of the November outage period, and little or none outside that window.

It’s also worth emphasising that there are lots of moving parts and assumptions built into these assessments, such as the timing of other generator outages which might well change as participants assess the impact of the LYA2 outage, and that any actions that AEMO might take on the RERT front to bolster physical supply reliability are not taken into account.

Market Price Outlook

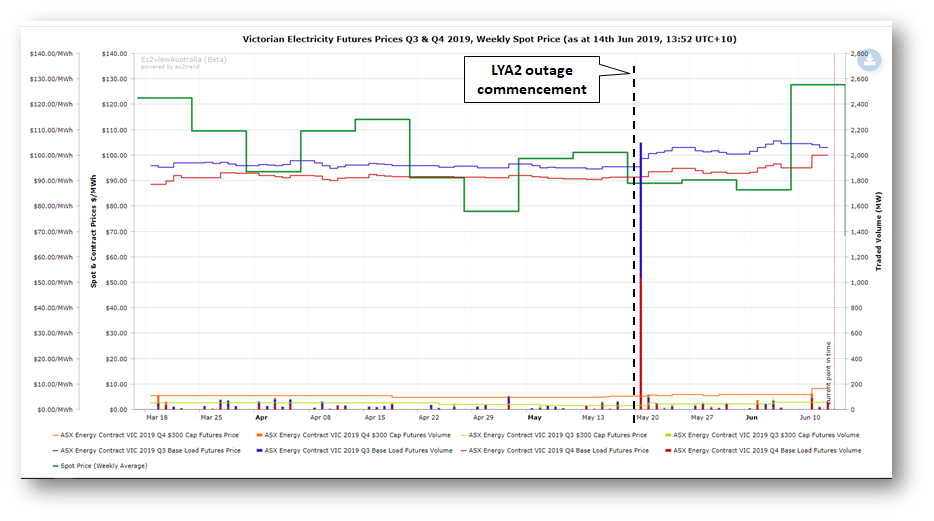

This second ez2view trend chart shows the market price impacts – if any – of the outage, on both spot prices in Victoria and forward contracts for quarters three and four of 2019:

The stepped green line shows that Victorian spot prices, expressed as weekly averages, have not changed markedly since the outage commenced on May 18th. The blue and red lines show traded forward prices for Victorian Q3 and Q4 baseload futures contracts respectively. These do show a reaction, having risen about $5-10/MWh and with more evident volatility since the outage commenced. Cap prices (the lower orange and green lines) have shown considerably less reaction, indicating that market sentiment sees less risk of outright volatility (“spikeiness”) in spot prices than of a general upward drift with the absence of lower-cost supply from LYA2. A final observation on this chart is the very large volume of baseload contracts (the chart columns) apparently traded just after the outage – over 1,000 MW of each. This is probably not new contracting activity but more likely an artefact of futures contracts being “exchanged for physical” – however the timing is very coincidental and reasons for it not at all clear.

Impact on AGL Financials

What if anything can be deduced from AGL’s announced FY2019-20 financial impacts from the outage (in the range of $60-$100M after tax)? A very simple computation of energy not generated as a result of the outage (around 1,500 GWh over July-November) implies a net before-tax cost to AGL of $60-$100/MWh. This is broadly in line with the gross cost of buying energy from significantly higher cost sources such as gas-fired plant or even directly from the spot market, and while AGL’s figure may include some element of repair costs on the damaged generator, it highlights the financial impact of losing access to a low variable cost source of energy in brown coal generation.

——————————————-

About our Guest Author

|

Allan O’Neil has worked in Australia’s wholesale energy markets since their creation in the mid-1990’s, in trading, risk management, forecasting and analytical roles with major NEM electricity and gas retail and generation companies.

He is now an independent energy markets consultant, working with clients on projects across a spectrum of wholesale, retail, electricity and gas issues. You can view Allan’s LinkedIn profile here. Allan will be sporadically reviewing market events here on WattClarity Allan has also begun providing an on-site educational service covering how spot prices are set in the NEM, and other important aspects of the physical electricity market – further details here. |

The 20th of May was swaption expiry for FY20. I believe the volume you’re seeing on the exchange is the delivery of underlying for in the money options. (If you look at the ASX trade log, you’ll also see a crazy range of transaction prices in that daily volume, which relates to the different strikes exercising. And the volumes for option exercises come in pairs (of 2, or really strips of 4) of the same volume.)