In the article I prepared this time last year, Let’s Talk About FCAS, readers were reminded that Ancillary Services Matter! In every power system around the world, be they large interconnected systems or smaller microgrids, the requirement to ensure this important element is addressed has continued to evolve. Within the NEM, we have seen the introduction of the Hornsdale Power Reserve dominate FCAS news (and so it should)! Through this post, I would like to reinforce for us to keep talking about FCAS because it still matters.

The previous article noted some of the reasons why we need services such as FCAS, and the importance they play in the stability of the grid. The recent work by the AEMC and AEMO have contributed substantially to the body of knowledge around technical capability and performance, and I would encourage people to get more involved in these discussions and forums. The success of the recent Hornsdale 2 FCAS wind farm trials, along with similar trials in California with a 300MW solar plant and continuing acceptance by transmission and market operators around the ability of inverter-based equipment to supply these services are all very encouraging.

But the piece I would like to focus on is the business case and subsequent optimisation challenge for getting involved in FCAS, now that the technical performance components have been mostly addressed. As one of my discussions recently noted, “we know we can do it [FCAS], but should we?”. The answer is … it depends!

There are numerous elements that enter the discussion around economic assessment of FCAS but the key factors include the technical capability of the unit or facility (ie the response capability and duration) and existing value/conditions of the underlying energy (ie PPA or merchant, environmental certificates etc). At present, most owners and operators would see generation maximisation as the primary means of revenue optimisation; and to a large extent that is correct.

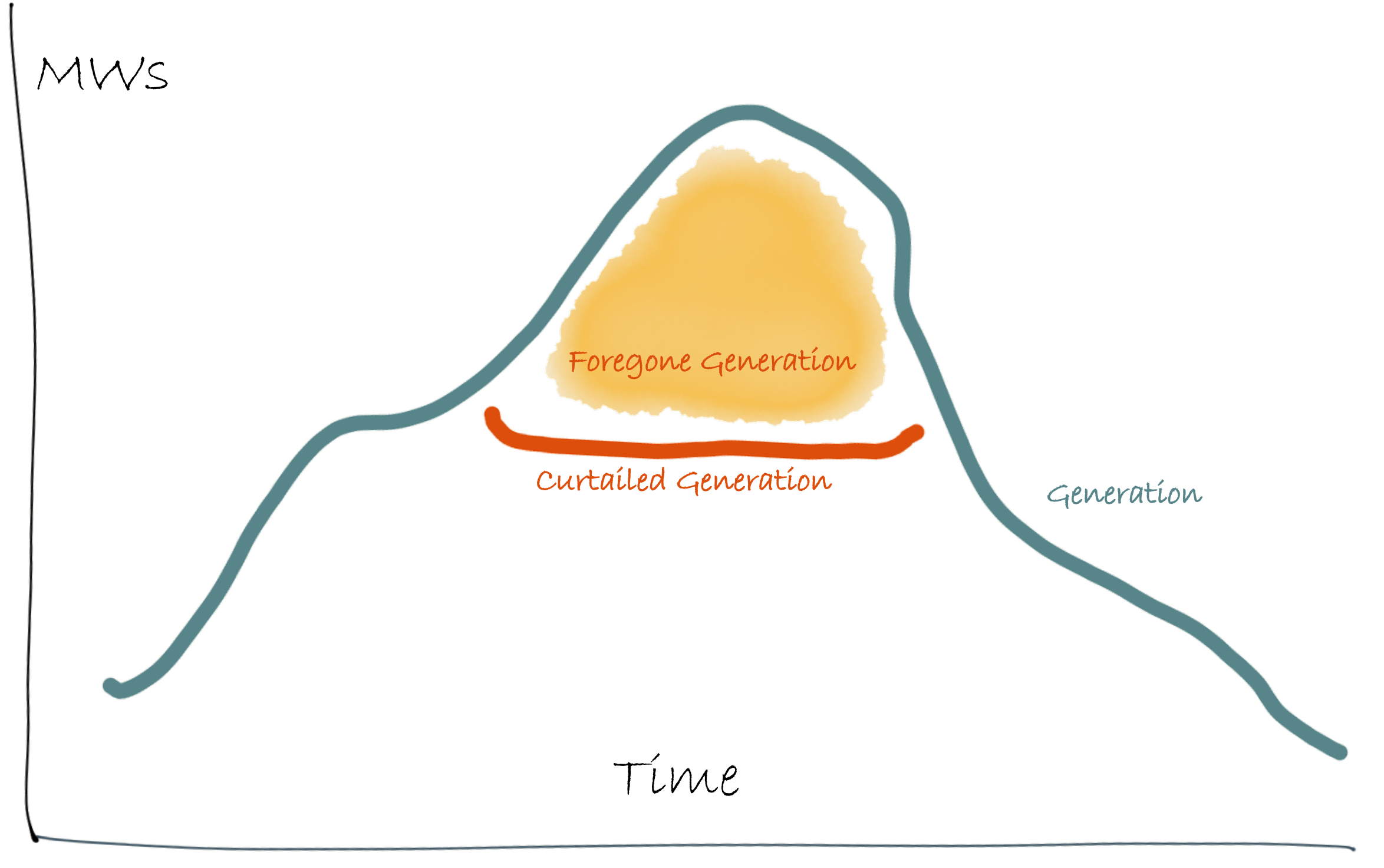

Increasingly, as further generation developments occur particularly with solar, the amount of underlying curtailment that may occur in various parts of the network will also be an important consideration. In the image shown below, the typical generation profile (green) may be impacted through the middle of the time period due to pricing and/or network constraint issues, resulting in periods of curtailment (orange). The resulting foregone generation (yellow) may be, at times, an ideal opportunity to provide FCAS raise services rather than simply forego that generation. But knowing when to take advantage of this opportunity is the realm of optimisation calculations … and that is where the fun begins.

When considering the type and nature of the optimisation for intermittent generation such as solar and wind, a secondary challenge comes from estimating what the green line would have been had the curtailment not occurred, a critical component for system operators when it comes to FCAS provision from intermittent sources. The possible or forecast power work is already covered in a WattClarity post by Harley Mackenzie.

Some of the other factors taken into consideration:

- What is the actual and forecast energy and FCAS price, and how likely are these to occur?

- What is the current and future generation forecast for the plant, and therefore, how much FCAS can be provided? and

- Any other control schemes or special requirements are in place that will impact on Energy/ FCAS optimisation?

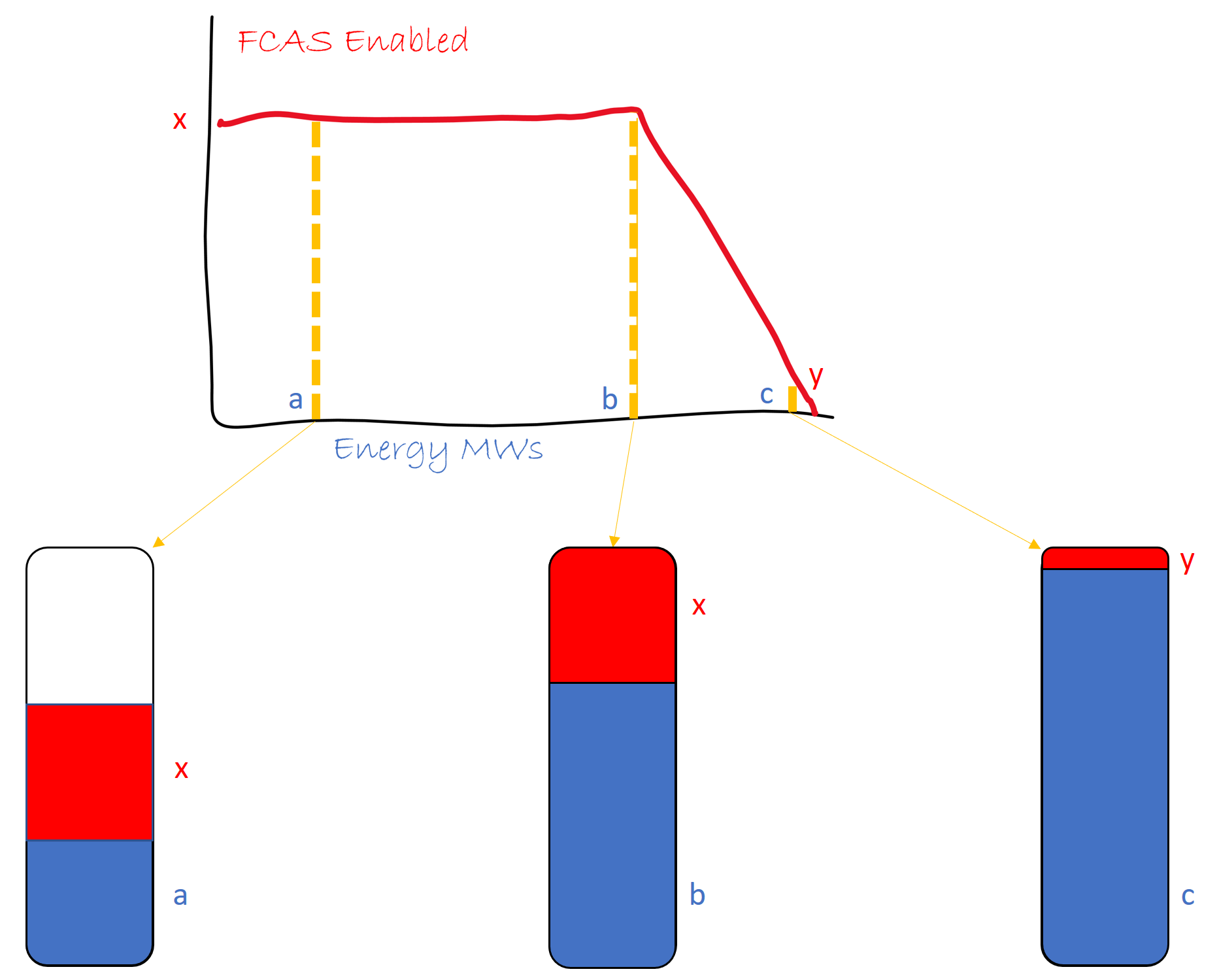

All of these elements have existed in the NEM since FCAS markets began in 2001. But it is one of the key elements of the FCAS market design, the FCAS Trapezium, that makes the NEM particularly well equipped to handle intermittent generation co-optimisation with 5-minute dispatch and FCAS markets. As the facility increases or decreases its energy MWs, the amount of FCAS that can be provided by the facility changes progressively (as denoted by the changing size of the energy (blue) and FCAS (red) amounts as demonstrated in the image below. In the particular example shown, at the top end of the Energy MW continuum, very little FCAS can be enabled because the facility cannot go much higher than its max capacity. Conversely, at the lower end of the MW continuum, a facility can only potentially ramp up by a certain amount during a frequency event, therefore it does not matter how much energy is curtailed below point b, the same amount of FCAS will be enabled (area x). When FCAS offers are submitted and combined with energy offers in NEMDE, an optimal dispatch across Energy and FCAS markets can occur and the cheapest solution possible is found.

Most batteries and solar plant, as well as some wind farms, can provide their MW response even while energy MWs are at/near 0MW, thereby allowing for potentially curtailed MW periods in the future to be provided by plant that may have been otherwise nearly offline.

Wrapping Up

Ancillary Services still matter! As the energy transition continues, the power grid will continue to show pricing signals for FCAS markets given the close co-optimisation between energy and FCAS market pricing in NEMDE. As some of the remaining technical boundary issues are solved, we look forward to observing a time when increasing amounts of solar, wind and battery supplied FCAS are enabled.

About our Guest Author

|

|

Jonathon has nearly 20 years practical experience in the Australian NEM, having held senior operational and trading roles in participant organisations and now as the Director of a specialist market consulting organisation, with a specific focus on renewable energy integration. Current clients include some of Australia’s largest integrated utilities, market regulatory organisations, transmission system operators and not-for-profit market observers. Jonathon has spent considerable time working with AEMO, Australia’s energy market operator.

As a former member of the NEM’s Dispatch and Pricing Reference group, Jonathon’s intricate knowledge of power system dispatch and security, coupled with practical, on-site experience with power system operations across all forms of electricity generation, allows him to bring operational and energy trading realities to strategically significant policy discussions. Jonathon has degrees in Engineering and Management, and is a member of the Australian Institute of Company Directors, CIGRE and IEEE You can find Jonathon on LinkedIn here. |

Be the first to comment on "Let’s Keep Talking About FCAS"