A very quick post prompted by the predispatch outlook for the rest of today and tomorrow:

With Adelaide at 42 degrees and Melbourne over 35 today, and similar-to-hotter forecasts for tomorrow, Thursday could be an interesting day in the southern NEM regions.

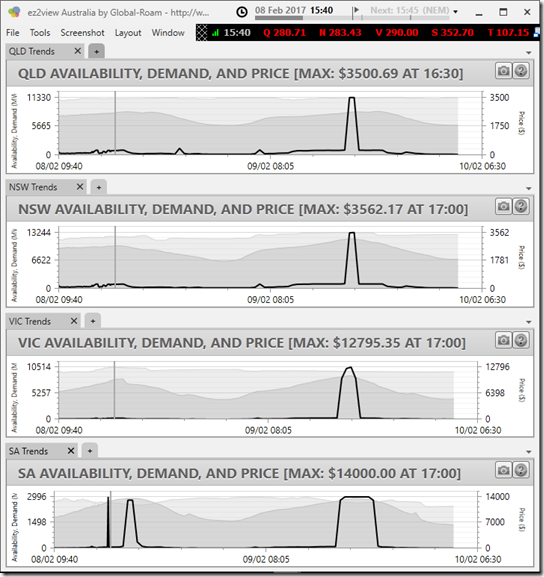

At the time of writing we’ve seen one 5 minute spike to just under the $14,000/MWh Market Price Cap in South Australia (driven by a short reduction in the Vic to SA export limit on the Murraylink DC interconnector), with more shown in predispatch, although that’s been changing considerably through the afternoon.

AEMO is forecasting combined SA + Vic demands peaking at over 11,700 MW tomorrow afternoon, nearly 1,200 MW higher than seen so far this summer, and the highest for three years. That is a key driver for the extended price spike shown on the predispatch forecasts for Thursday – although there is plenty of time for demands, generator bids, and other things to change between now and then.

|

Allan O’Neil has worked in Australia’s wholesale energy markets since their creation in the mid-1990’s, in trading, risk management, forecasting and analytical roles with major NEM electricity and gas retail and generation companies.

He is now an independent energy markets consultant, working with clients on projects across a spectrum of wholesale, retail, electricity and gas issues. You can view Allan’s LinkedIn profile here. Allan will be regularly reviewing market events here on WattClarity. Allan has also begun providing an on-site educational service covering how spot prices are set in the NEM, and other important aspects of the physical electricity market – further details here. |

Murraylink is exporting at twice the limit the constraint is set to. Doesn’t look like any spare generation in SA at the moment. LOR2 already declared, waiting for the LOR3. Perhaps we will dodge it?

We didn’t dodge the LOR3. Up to 100MW rotational load shedding implemented. TIPS A1 unit was offline, I assume for maintenance. That would have saved us but shows the supply situation is very tight on hot days. TIPSB1 has a blip and went back to 150MW for awhile as well, it hasn’t been outputting it’s nameplate (200MW) for awhile.

Ian,

Here’s the first review:

https://wattclarity.com.au/2017/02/load-shedding-occurs-in-south-australia-in-heatwave-conditions/

Paul

Ian

Sorry not to respond earlier to your comments, afraid I got busy digging deeper into the events of yesterday – shows how in the above post I focussed on Thursday’s outloook and completely missed the risks just around the corner. If I lived in Adelaide I suspect I would have realised that AEMO’s predispatch was well on the low side.

Should be more about Wednesday on WattClarity this afternoon, but your observations are right, Murraylink exceeding constraint limits especially.

Cheers

Allan