We read, this afternoon, about EnergyAustralia’s flagging of the possibility of closing more capacity.

This is a situation that’s not unique to just this company – nor just to coal power stations:

1) Paul Simshauser, Tim Nelson and others at AGL have been vocal about the massive oversupply of capacity currently depressing prices (which, they note – like at the forum linked here, has been driven by incentives layered on top of the energy-only market – some green, some gas, some other).

2) Stanwell has been vocal about the impact of rooftop solar PV in Queensland.

3) It’s been noted how even existing wind farms are suffering from problems of wind farm companies (e.g. Infigen and Pacific Hydro).

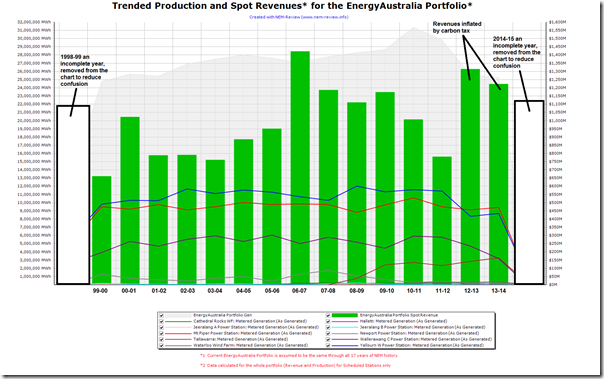

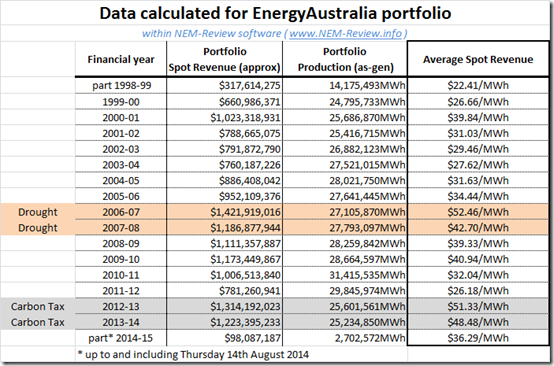

Powering up NEM-Review, we crunch the numbers for EnergyAustralia’s existing portfolio to show how production volumes and spot revenues would have trended since the start of the NEM, assuming that the portfolio had been the same through the entire 16-year history:

Note that the production and spot revenue figures for the whole portfolio are calculated for scheduled units only (whereas metered generation can be shown for the individual stations). What’s particularly telling is that when we combine these figures, we can calculate these average spot revenue per financial year:

The 2006-07 and 2007-08 years are the standouts, because the effective capacity in the NEM was substantially reduced due to the drought.

More recently, though, (no matter whose estimates you take for a long-run marginal costs) it’s clear that dropping revenues since declining demand began to take hold mean an inadequate return (notwithstanding the argument about depreciation on existing assets) and something’s gotta give…

Leave a comment