Given that we’re looking to update the popular “Power Supply Schematic” and “Power Trading Schematic” Market Maps™ during 2014, we’ve had another reason to watch with interest the ongoing power generator privatisation process in NSW.

On Tuesday we saw the not (oops!) unsurprising decision by the ACCC to reject the NSW Government’s anointed bid placed by AGL Energy. This possible outcome had been flagged a month earlier in the ACCC’s statement of issues.

Of course, this process is not necessarily dead yet (AGL’s successful acquisition of Loy Yang A in two tranches highlights some options that might be pursued), but it does flag the possibility that the NSW Government may be stuck – unable to offload its stake in Macquarie Generation.

What this might mean for the Delta Coastal sale process is entirely speculation – but, with the market now knowing there were only 3 bidders for Macquarie Generation (only one of whom bid above the reserve price) perhaps it does make it even more of a buyer’s market for the smaller asset?

This makes us wonder (again) about a left-of-field option as a possible resolution….

Back in 2008 we suggested that one possible privatisation option might be to merge together the current GOC generators in NSW and QLD and take the two combined (larger and more robust) entities to the market.

The three-into-two merger that occurred in QLD a couple years ago was one of the factors that contributed to the significant volatility seen in QLD during summer 2012-13 (explained in further detail in our report), which flowed through to forward prices. The larger portfolios (and easier deducibility of competitor’s positions) enabled a number of strategies to be implemented.

Compare this to the flat-as-a-tack prices seen in NSW in recent years and you’ll understand the potential these merged entities would represent for recovery in prices, and hence portfolio-wide asset values (though it would require selective closure).

What would they look like?

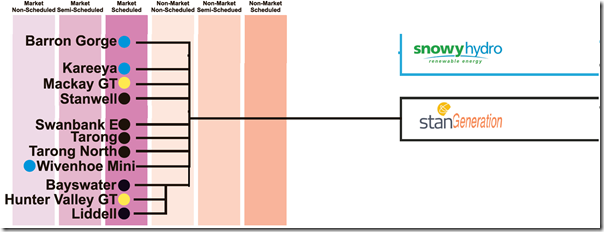

If we assume that the Stanwell and Macquarie Generation portfolios were merged together, the resulting generator (which would be – at least initially – jointly owned by the governments of NSW and QLD) would provide a sizeable portfolio into the market – as shown here in this hypothetical excerpt from a 2016 Issue of our “Power Trading Schematic”:

Perhaps this might be called “StanGen”.

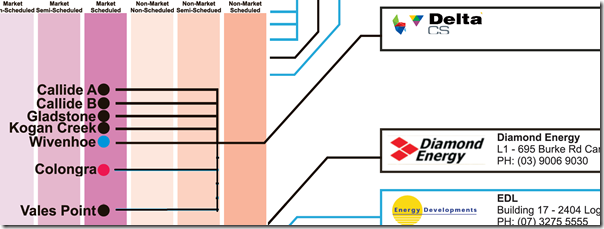

The other competitor, a merger of Delta Coastal and CS Energy (perhaps “DeltaCS”) and would look something like this, in terms of the assets traded through the AEMO’s wholesale market:

To satisfy each state’s parochial interests, the head office of one of these corporations could remain in Brisbane and the other in Sydney/Newcastle.

NSW and QLD Government Exit Strategy

Without running some detailed modelling it’s impossible to know for sure (and, even in that case, the GIGO rule would also still apply), but it seems likely that the combined entities would be able to contribute to significant revenue recovery across their portfolios which, along with some cost savings that would result from merger benefits, would deliver an uplift in asset values.

There’s been much discussion about how declining demand has been eating away the asset values of the existing generators. This trend looks set to continue (due to many more factors than just solar PV – despite it being cause du jour).

We understand there are those who are concerned about the market consolidating to the point where there might be only three significant gentailers, which might squeeze other challengers out of the market (we note there are plenty of industries in Australia where there are only two dominant competitors – perhaps plus a challenger). For people who feel this concern, this option might result in there being more significantly sized generation portfolios.

Again, some detailed number crunching would be required but it seems likely that these two new entities would be significantly sized such that they would be necessary counterparties to the retailers seeking hedge cover to compete in the NSW and QLD regions.

Proceeding down this path would not happen overnight, but would seem to provide the option for the NSW/QLD governments to progressively sell down their stakes via IPO hence establishing two sustainable competitors in the National Electricity Market. Possibly further down the line, these companies might seek to vertically integrate themselves, by expanding into retail (possibly through purchase of the dwindling number of mid-sized retailers that remain independent).

There is a precedent to various government bodies owning stakes in power generation assets – Snowy Hydro operates in this way.

One thing’s for sure – such a move would necessitate another update to our Market Map™ wall charts.

Leave a comment