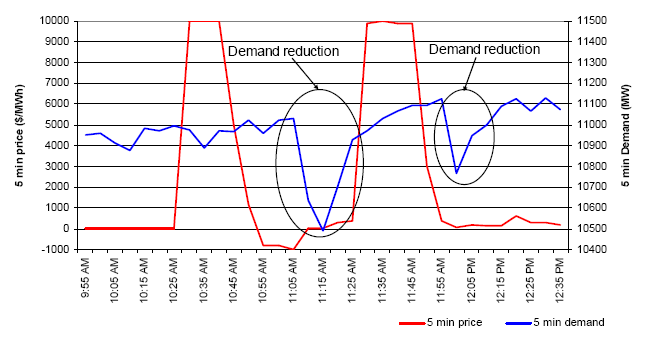

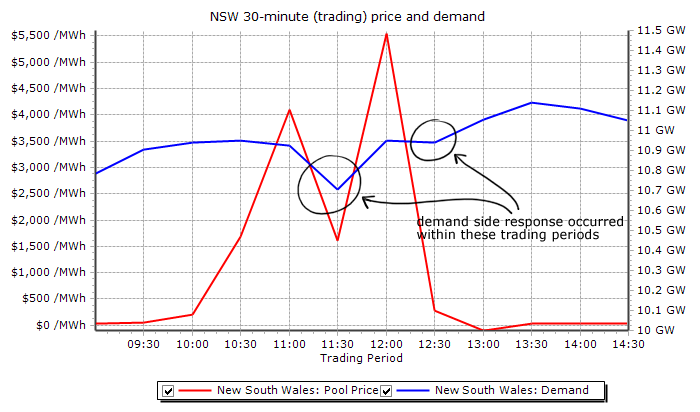

On the 4th of February at around 11am energy users in NSW appear to have curtailed their load in response to high prices, resulting in a significant drop in demand. Simultaneously, network conditions and generator rebidding caused the NSW pool price to jump back and forth between extreme prices close to VOLL ($10,000/MWh) and the Market Floor Price (-$1,000/MWh).

Chronology of Events

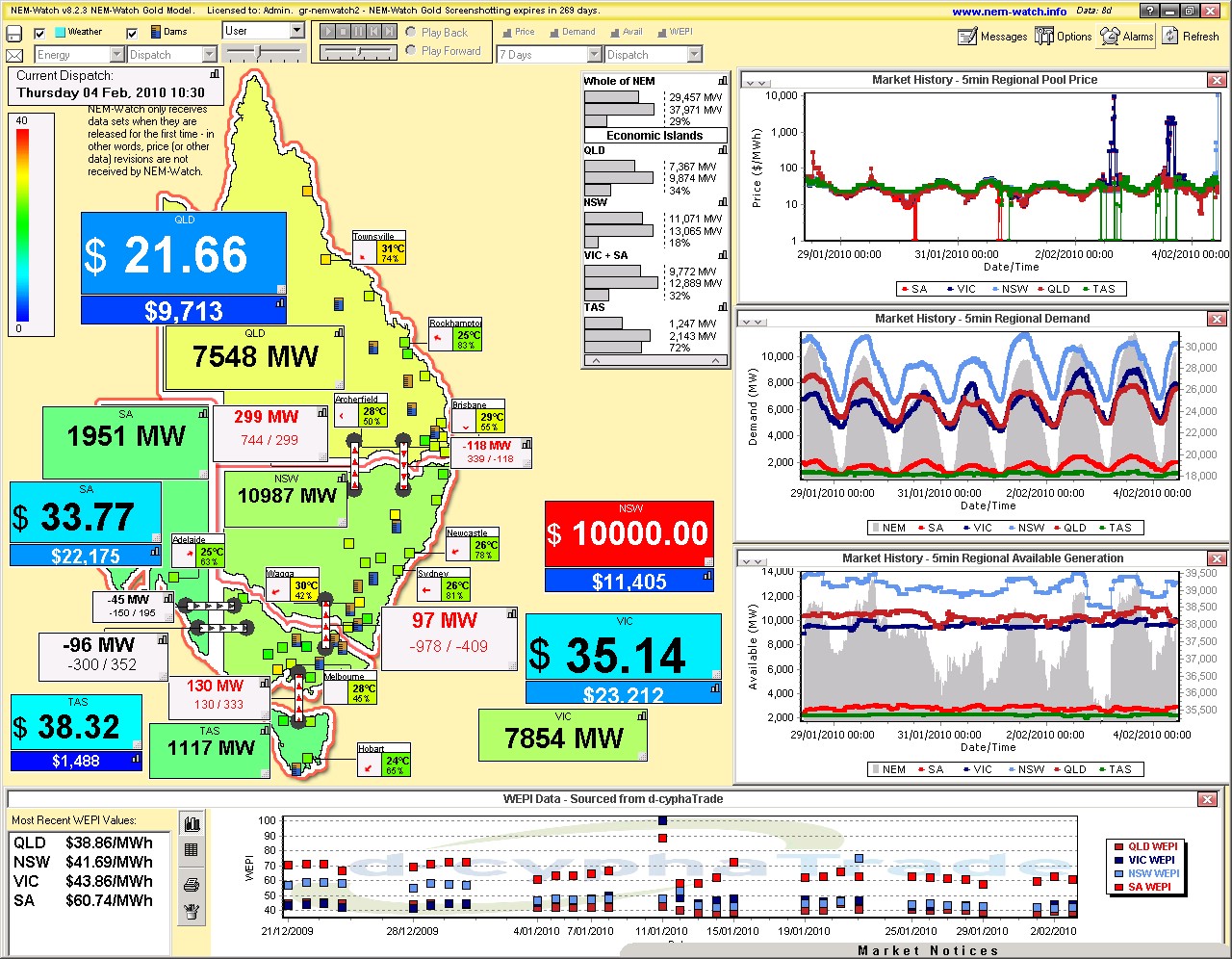

At 10:30 the NSW price spiked to VOLL due to network congestion (while NSW demand was close to 11000MW). The AER explains the network conditions leading up to the spike:

“From early in the day network equipment… supplying the Sydney Central Business District (CBD) was out of service for planned maintenance. From mid-morning potential overloads were identified for flows on the 330 kV cables supplying the CBD from Sydney South. In response, at 10.25 am the Kemps Creek to Sydney South 330 kV transmission line was taken out of service… This altered flows on the remainder of the transmission network and flows exceeded allowable limits on the Mount Piper to Wallerawang 330 kV lines for three dispatch intervals (10.30 am to 10.40 am inclusive).

“The constraint used to manage flows across the Mount Piper to Wallerawang lines reduced the dispatch of low-priced generation and forced flows out of New South Wales into Victoria and Queensland, setting the dispatch price to $10 000/MWh for three dispatch intervals from 10.30 am.”

The screenshot below, taken automatically by NEM-Watch, shows the state of the NEM at the time of the spike.

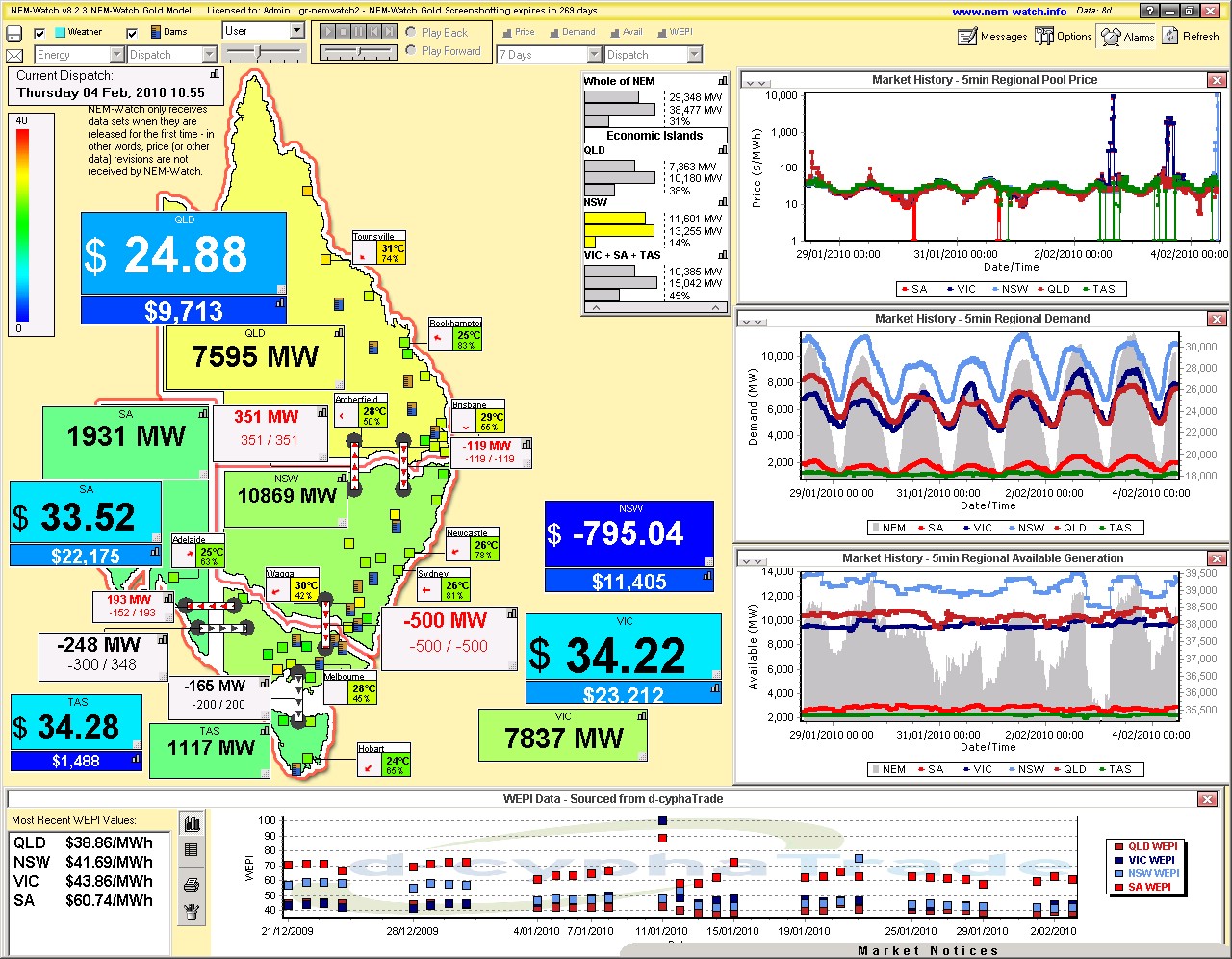

The AEMO states in the pricing event report for the day, “at 10:30hrs, 6200MW of NSW generation was offered in negative price bands. Negative offers increased to 8500MW at 10:35hrs, and 10600MW at 10:40hrs.” As a result of generators rebidding higher capacity at negative prices, at 10:55 the NSW price dropped to -$758/MWh (shown in the screenshot below).

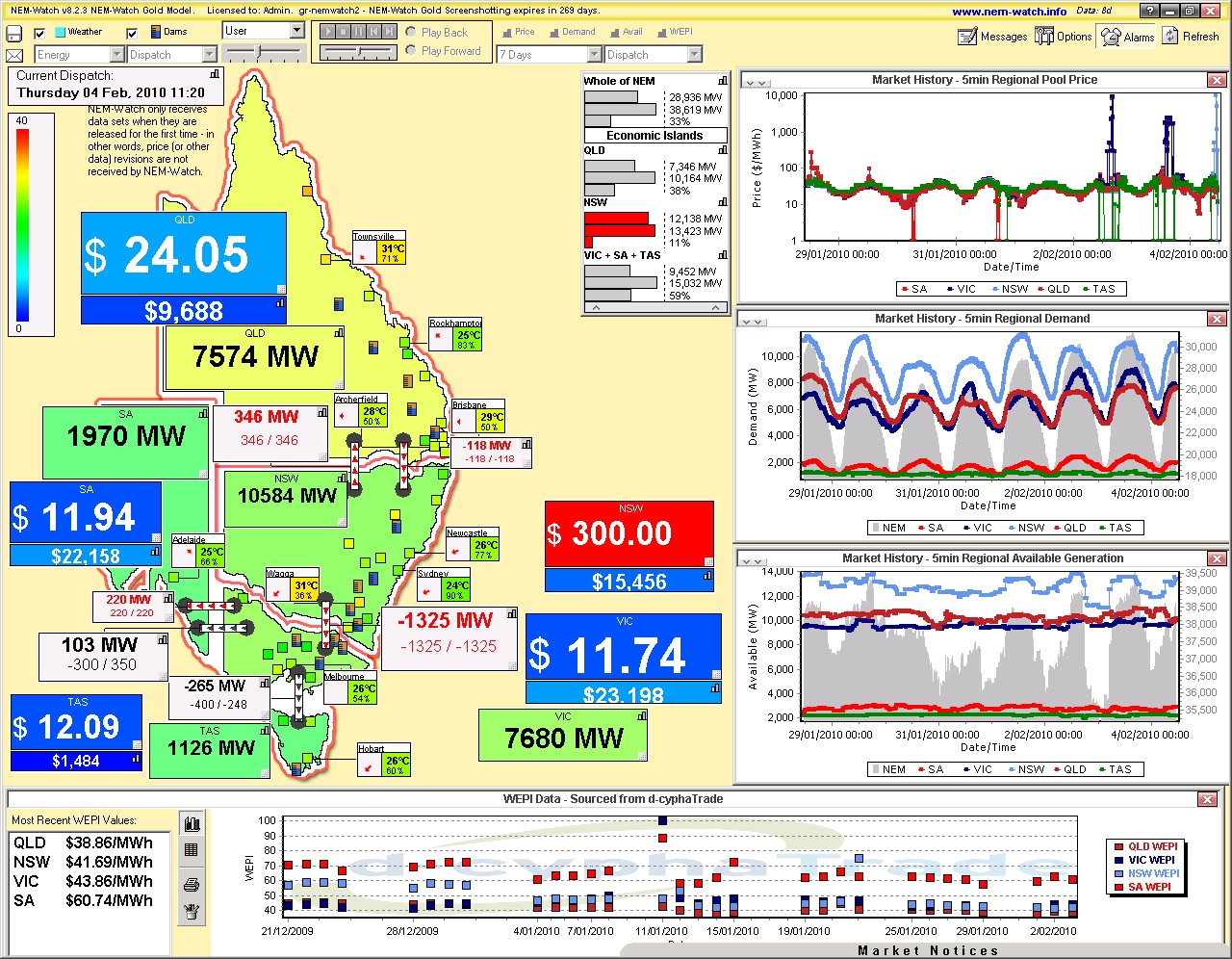

In response to the high prices, it appears that demand side response caused a reduction of around 600MW at around 11:00. By 11:20 demand had risen to 10584MW, and negative bids from generators had reduced to 10300MW, pushing the NSW price back up to $300/MWh.

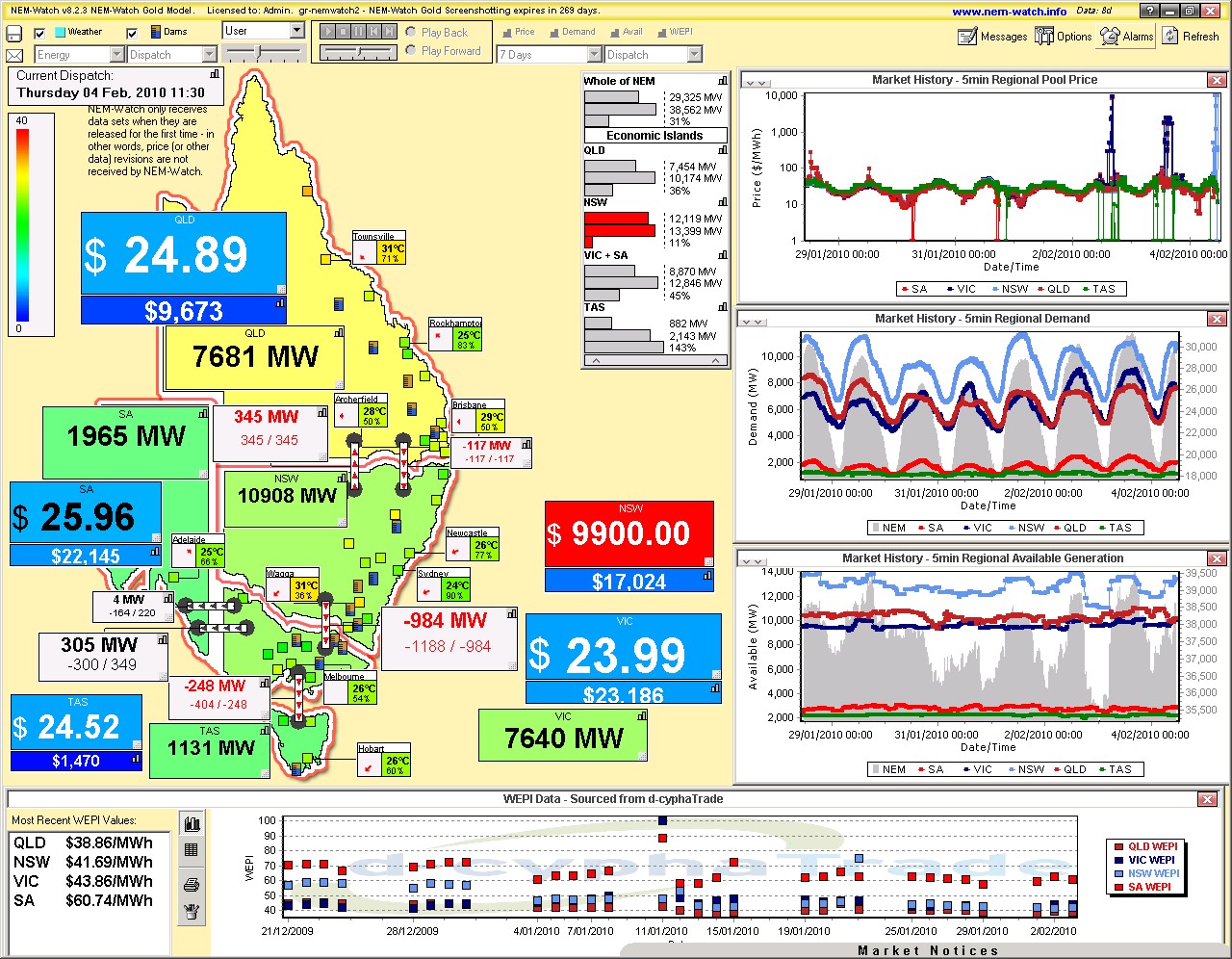

At 11:30 the price increased to $9900/MWh and remained close to VOLL for the next four dispatch intervals.

At about 12:00 there was another instance of demand side response, evidenced by a reduction in demand of around 300MW. At this time the NSW pool price dropped back to a more moderate level.

During the 12:45 dispatch interval, the price dropped to -$996.81. The AEMO explains:

“The Mt Piper 330/132kV transformer was returned to service at 12:40hrs, reducing the flow on lines 70 and 71 by 100MW and relaxing the Kemps Creek-Sydney South (13)) outage constraint. Unconstrained generation in the negative price bands became marginal and prices were set accordingly. “

This set the price for the 13:00 trading interval was set to -$98.53/MWh.

Overview of Price and Demand

NSW Five-minute price and demand

From the AER’s report – Electricity spot prices above $5000/MWh – 4 February 2010.

NSW Thirty-minute price and demand

Generated with NEM-Review v6.

For much more detail including forecast vs actual price and demand, interconnector and transmission constraints and generator offers and rebidding, see the AER’s “Electricity spot prices above $5000/MWh” report.

Be the first to comment on "Demand Side Response in NSW on 4th February"