What a day!

Unlike other days in the previous couple of weeks when either demand rose in VIC and SA or rose in NSW and QLD, today saw high temperatures experienced across the mainland, leading to higher demand levels in all 4 mainland regions.

Certainly the peak demand experienced today (33,321MW on a dispatch demand target basis for the 14:50 dispatch interval) was much higher than the demand experienced in any previous November month. Yet it was still more than 2,000MW off the record demand level set the previous summer.

Here’s a few random snapshots taken from NEM-Watch over the past 18 hours or so (I just have not had the time to sort this in any more detail):

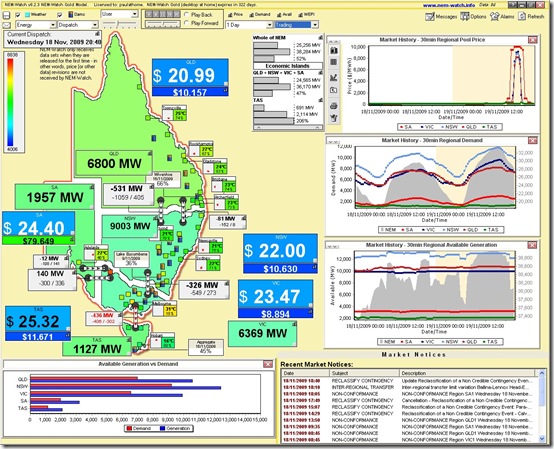

Wednesday 18th November at 20:40

As can be seen here, the previous evening AEMO started warning of the likelihood of price spikes in their predispatch forecasts (shown in the orange shaded area in the chart in the top-right of NEM-Watch):

Coincident with that, my mobile phone was peppered with SMS alerts set up to alert me to the possibility of that happening.

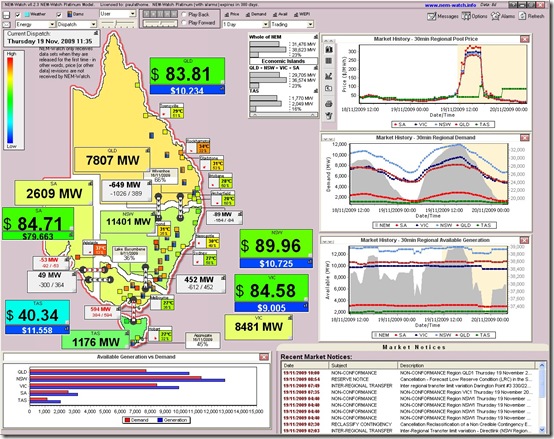

Thursday 19th November at 11:35

The day started innocently enough – note that by morning the predispatch price forecasts had mellowed (dropping from price forecasts at VOLL to forecasts for only of the order of $300/MWh):

The earlier forecasts would turn out to be more prophetic!

Note that the NEM-wide demand was 31,476MW at this stage

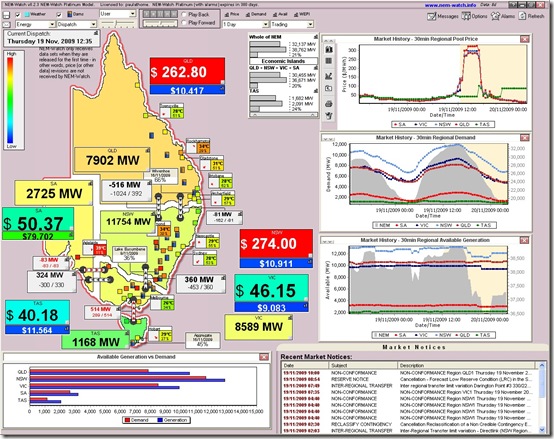

Thursday 19th November at 12:35

One hour later, we see that demand had increased by 661MW across the NEM. Prices had started to rise in QLD and NSW as a result.

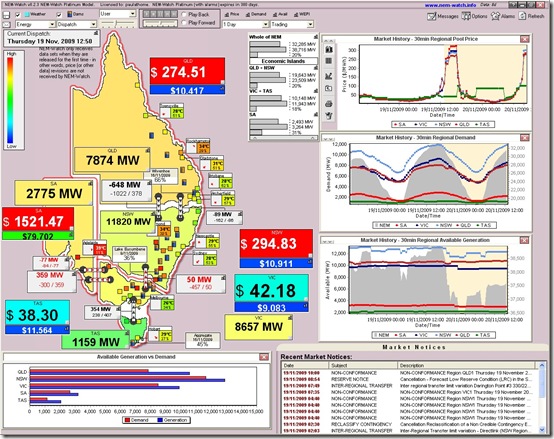

Thursday 19th November at 12:50

Within half an hour, the price had spiked to $1500/MWh in South Australia (note that the Cumulative Price had dropped off to $79,702/MWh – leading to price caps being removed).

As can be seen in this image, SA was still enjoying a surplus of 771MW at the time (representing 31% of the local effective demand supplied by generators in the SA “Economic Island”).

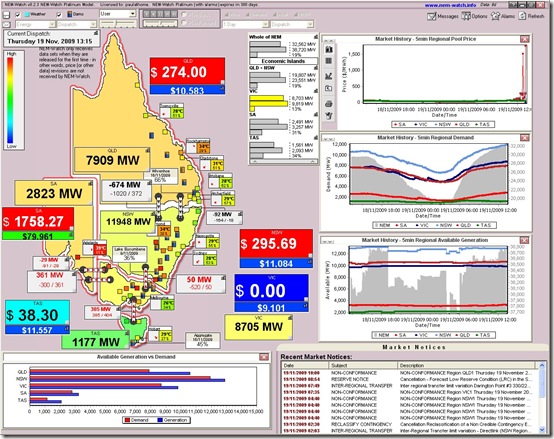

Thursday 19th November at 13:15

Here’s a snapshot of an interesting dispatch period, where the price in VIC has dropped to $0/MWh because of the constraints on interconnectors exporting from VIC (and the fact that Basslink is being forced to continue sending power north).

Note that the supply/demand balance is tightest in the VIC Economic Island, and yet prices are lowest – which initially appears counter-intuitive. Just one of the strange outcomes that can result from interconnector constraints!

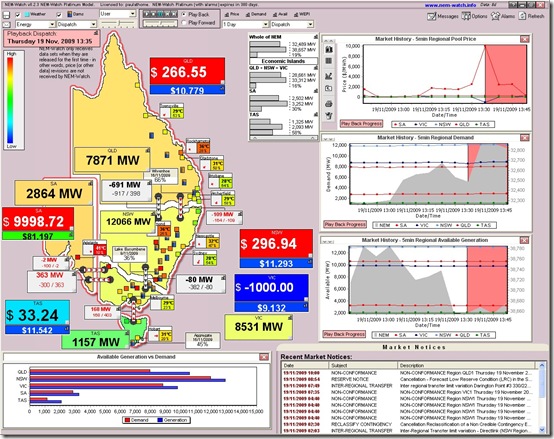

Thursday 19th November at 13:35

See here a more detailed view of an instance 20 minutes later when prices in VIC fell to the negative cap whilst prices in SA rose to VOLL.

In the detailed charts on the right, we can see both a reduction in NEM-wide demand (approx 200MW in 10 minutes, possibly due to demand-side response) and a reduction in the amount of generation capacity available, as well (approx 120MW in 30 minutes).

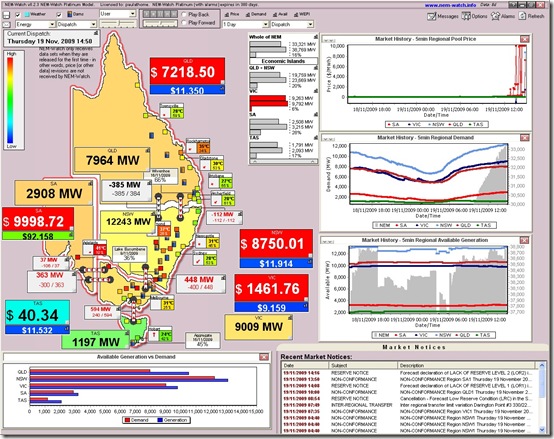

Thursday 19th November at 14:50

Here’s a snapshot of the 14:50 dispatch interval, when the NEM-Wide demand reached its maximum for the day – and easily breaking the record for any previous November month.

See that prices were high across the NEM – though lower in VIC despite the fact that supply/demand balance was tightest there (with only 529MW of spare capacity, representing just 6% of the “effective demand” (demand + exports – imports) supplied by VIC generators in the VIC “Economic Island”.

Friday 20th November from 15:30

Note in the “Market Notices” window on the lower right of the display just above that AEMO had issued a Reserve Notice at 14:16 market time warning that supplies were forecast to be tight in NSW tomorrow:

AEMO considers that the occurrence of a credible contingency event is likely to require involuntary load shedding in NSW region, for the following period,

FROM 1530 hrs 20/11/2009 TO 1630 hrs 20/11/2009

The minimum reserve is 568MW at 1600 hrs

Note that this was just a warning to the market to say that action would be needed if the largest generator falls offline tomorrow during those times.

Leave a comment