Because supply and demand need to be balanced in real time in the electricity market (with system frequency being the instantaneous measure of imbalance between supply and demand as discussed here), there is considerable focus in the NEM Rules placed on notifying the market of forecast potential (or actual) imbalances.

One of the primary means of doing this is through a tiered system of Low Reserve Condition (LRC) warnings – which are propagated more broadly via Market Notices.

These LRC notices are primarily focused on eliciting a market response (i.e. more supply capacity to be made available, or some demand response).

These alerts can be issued either :

(a) with respect to the current time, or

(b) at some forecast time period into the future (even as far out as the MT PASA time horizon).

… so it is important that you take particular notice of what the time-frame is pertaining to the alert.

Because these are intended to encourage market response, there will be more LRC notices pertaining to future points in time than there will be those pertaining to real time.

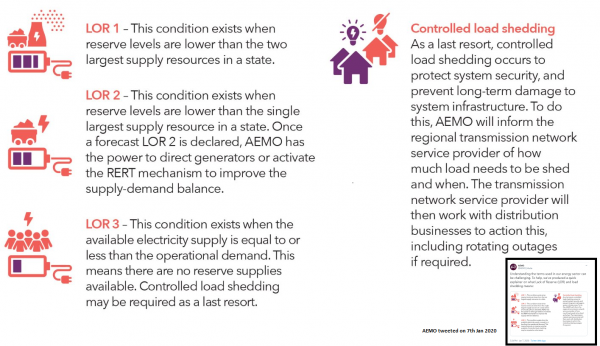

In order to help us understand the severity of the tightness between supply and demand, the NEM Rules specify these three tiers: of “Lack of Reserve” (LOR):

| LOR1 (Lack of Reserve Level 1) | This is the least severe level of alert.

In simple terms, it means that if the largest ‘credible contingency’ were to occur in the region, then AEMO expects that the region would be in LOR2 territory. |

| LOR2 (Lack of Reserve Level 2) | This is the middle level of alert. It can also work in real time, or forecast.

In simple terms, it means that if the largest ‘credible contingency’ were to occur in the region, then AEMO expects that the region would be in LOR3 territory (i.e. Load Shedding). |

| LOR3 (Lack of Reserve Level 3) | This is the most severe level of alert, and means that: (1) If issued about the current time, the AEMO is currently proceeding with Load Shedding; or (2) If a forecast, the AEMO is currently expecting that they will need to proceed with Load Shedding – at the time indicated in the forecast. As such, the settlement price should equate to the Market Price Cap at these periods of time (notwithstanding the effect of Administered Pricing, if applicable at the time). |

Some prior articles talking about Low Reserve Conditions on WattClarity are tagged here.

——————–

I noticed that (very helpfully) the AEMO tweeted an explanation here on 7th January 2020, so I have copied that in here: