Government involvement in the electricity supply sector has been (for at least 30 years) something fairly topical – with sound arguments being mounted both for, and against, this situation.

Given I’ve been based in Queensland whilst working in the Australian Electricity Supply Industry for a number of decades, it’s easier for me to compile a history of key milestones along the journey of Government involvement. My sense is that this is something I’ll be referring to a number of times (in addition to this article today ) – hence I have separated it out into its own post.

1) Trended prices

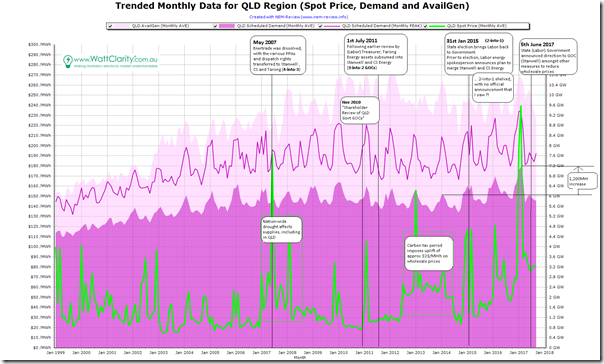

Powering up NEM-Review v6, I’ve produced the following longer-run trend of Queensland region outcomes since January 1999 (to September 2017), and included a couple particular annotations:

For clarity, I have highlighted the 24-month period of the carbon tax, and also the period in which generation supplies nationally were affected by the NEM-wide drought of 2007.

2) A chronological record, including external links at key dates

In the following table, we’ve tried to link to include a number of the key pieces of historical record in order to provide a more objective record of how the Queensland Government involvement in the energy sector has progressed:

| YEAR | MONTH | KEY EVENT |

| 1994 | March or April? | A consortium including Comalco and others purchased the Gladstone Power Station from the QLD Government (via the Queensland Electricity Commission). Part of the sale arrangement included specific dispatch rights at the Gladstone station. |

| 1997 | ?? | The Queensland Transmission Supply Corporation (QTSC), acting for the QLD Government, signed power purchase agreements with private sector players for the development of three peaking power stations – Oakey, Mt Stuart and Yabulu peaking generators. |

| 1998 | January | Queensland Interim Market started, prior to the initiation of the NEM |

| December | Operations of the National Electricity Market begins, with QLD still islanded from the rest of the NEM. | |

| 1999 | January | The time-weighted average price for the month of January 1999 was $99.70 – just below the $100 mark, as seen in the chart above. |

| 2000 | January | The time-weighted average price for the month of January 2000 was $102.20/MWh – as seen in the chart above. |

| April | Directlink operations begin (a little behind schedule), interconnecting QLD to the southern NEM (via DC) for the first time. | |

| ??? | The QLD Government 13% gas scheme announced. | |

| 2001 | January | QNI operations begin, interconnecting QLD to the rest of the NEM with an AC link for the first time. Being a larger link, it has more impact in reducing prices, and price volatility. |

| February | Callide C unit 1 begins operation (with the unit 2 operational before the end of the year). This was built as an unincorporated joint venture between the QLD Government (through CS Energy) and the private sector (via Intergen). | |

| 2002 | May | Swanbank E begins operations. This was built by the QLD Government (through CS Energy) but I can’t recall if there was a private sector player initially involved? |

| November | Tarong North begins operations. This was built as an unincorporated joint venture between the QLD Government (through Tarong Energy) and the private sector (via TEPCO I think). | |

| 2003 | . | |

| 2004 | . | |

| 2005 | January | The QLD Government 13% Gas Scheme began operations – requiring Queensland retailers to ensure procurement of certain percentages of gas-fired electricity. |

| 2006 | . | |

| 2007 | May | Kogan Creek begins operations. It was developed by the QLD Government (through CS Energy) but I can’t recall if there was a private sector player initially involved? |

| Also in May was the 4-into-3 merger.

Enertrade was dissolved, with the various PPAs (and dispatch rights) that it managed were transferred to the three remaining generators (Stanwell, CS Energy and Tarong). |

||

| June | The time-weighted average price for the month of June 2007 was $192.45/MWh – as seen in the chart above.

As shown on the chart above, the drought had a significant causal relationship (it affected power supplies in Queensland but also around the southern regions as well). Winter 2007 did see a shortage of available capacity across the NEM. |

|

| 2008 | February | The time-weighted average price for the month of February 2011 was $131.11/MWh – as seen in the chart above.

Particularly noteworthy was the weekend of 22nd and 23rd February, where a rare hot spell saw demand levels up and 5 hours of prices above $2,000/MWh as a result. Incidentally, it was bidding behaviour over this weekend at Stanwell Corporation called into question in the case of Australian Energy Regulator v Stanwell Corporation Limited (which the AER subsequently lost, but which has flowed on through to more recent changes in the rules). |

| 2009 | ||

| 2010 | 25th November | This “Shareholder Review of Queensland Government Government Owned Corporations” was published. |

| 2011 | February | The time-weighted average price for the month of February 2011 was $105.66/MWh – as seen in the chart above. |

| 10th March | ON 10th March, the Finance Minister in the Bligh Labor Government provided this statement on the asset allocation.

This noted a slight change in the asset allocation compared with what was suggested in the Shareholder Review (Nov 2010, above). |

|

| July | 3-into-2 merger

Tarong Energy Corporation was dissolved, and the assets subsumed into the 2 remaining GOCs, Stanwell Corporation and CS Energy. |

|

| 2012 | July | The 2 year long carbon tax period commenced, adding approximately $23/MWh to trading prices at every trading period.

|

| 2013 | January | Summer 2012-13 was a massive one, in terms of spot price volatility (layered on top of the uplift from the carbon tax). The time-weighted average price for the month of January 2013 was $155.90/MWh.

On WattClarity we posted numerous articles analysing aspects of the volatility including: Volatility through summer 2012-13 was so severe that we prepared a detailed 100+ page report that examined this in detail. Note the reduced price for those who would still like a copy at this point. |

| 2014 | July | First month without the carbon tax, though it took longer to wind out of the wholesale market completely because of the effect of hedging. |

| December | Summer 2014-15 saw very high prices leading into the election on 31st January 2015. Time-weighted average prices for the months of December 2014, January 2015 and March 2015 were all above $100/MWh – as seen in the chart above.

|

|

| 2015 | 31st January | The Palaszczuk Labor Government is elected into power, defeating the Newman LNP Government.

Electricity sector policy had been a hot-button issue during the campaign with: |

| Following the election win, there was much discussion (behind closed doors and in the press) aimed at helping the new Labor Government understand how the proposed 2-into-1 merger would light a rocket under wholesale prices.

There’s this note from the Courier Mail on 19th March, for instance quoting the ACCC chairman: |

||

| December | I’ve just found this article in the AFR from 14th December “QLD energy genco merger to be scrapped” with the article noting: ”But the merger of CS Energy and Stanwell Corporation will be dumped after serious concerns were raised by the Australian Competition and Consumer Commission about a lack of competition in the state’s electricity generation sector” The article also notes: ”In a further move to try and shore up the state’s budgetary position after abandoning $37 billion in asset sales, the Palasczuk government will proceed to load up its government-owned corporations…with more debt”I’ve also just found this undated note on the Parliamentary website that notes the decision that: ”The generation businesses will remain as separate businesses. The Queensland Government will undertake a strategic review of the businesses to identify further efficiency opportunities”So the plan to merge 2-into-1 was squashed, but no move was made to de-merge 2-back-into-3. |

|

| 2016 | February | The time-weighted average price for the month of February was $121.31/MWh, which was more than double the outcome for December and January. |

| July | On 4th July I posted this review of Q2 prices for all years including 2016 (just passed) and questioned whether it was a systemic change in pricing patterns. | |

| 2017 | January | Summer 2016-17 saw astronomical prices in QLD, as seen in the chart above. The time-weighted average price in Queensland for the month of January was $197.65/MWh.

I labelled Saturday 14th January “sizzling Saturday” because of the extremes in temperature, hence high demand and prices that resulted. A few days later I posted this more forensic look at Queensland Price Volatility on the day. This post included an animation that looked in detail (dispatch interval by dispatch interval) at generator bidding through the period. |

| February | Price outcomes were even worse for the month of February (where the time-weighted average price was $239.59/MWh for the whole month). | |

| July | On 6th July I posted this updated review of Q2 prices taking into account the extremes experienced across all regions in 2017.

On 11th July on WattClarity, I highlighted the 3 big reasons why wholesale power prices were higher in Queensland than they used to be (including the 3-into-2 merger). |

|

I’d be happy to add in references to other key events in this table, if you can point them out to me (offline or online).

Kogan Creek was originally developed in conjunction with US utility Southern Corporation until CS Energy bought them out. Swanbank E was developed by CS Energy without any JV partner.

It is also worth mentioning the Braemar 1 (450MW in 2006), Braemar 2 (450MW in 2009) and Darling Downs (630MW in 2010) gas fired stations which added significant capacity to QLD.