This week (Tuesday 18th and Wednesday 19th July) I’ve been pleased to be able to attend the Clean Energy Council (CEC)’s Clean Energy Summit in Sydney. A well-attended forum by CEC Members and other interested industry stakeholders.

In the lead-up to the Summit, I was asked to speak in a session focused on forecasting for the wholesale market, and for LGCs. As I explained to my audience, I was a little surprised to be asked to speak in a forecasting forum, given my my prior comments on why forecasting is a mug’s game.

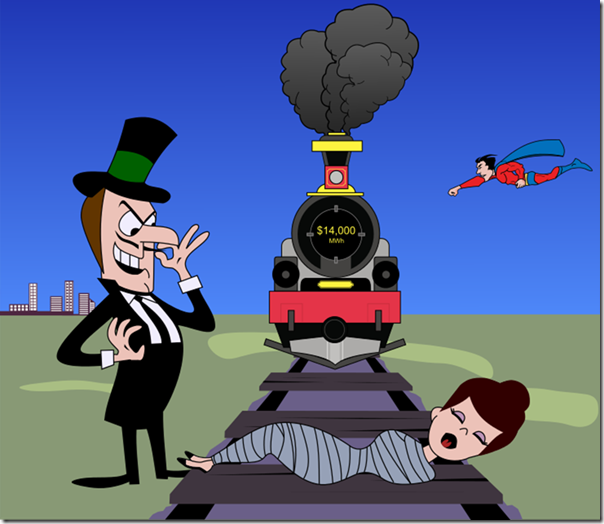

Given that we’re not a company that provides numerical forecasts, but that I have been puzzling through the wicked problem of resolving the Energy Trilemma that’s upon us, I shared some of my perspectives of the challenge that is upon us. I summed this up in the following 4-actor caricature:

I don’t have enough time today to translate my presentation to a written post here on WattClarity (and it would be too long in any case), so will endeavour to progressively provide shorter snippets as sequential posts:

1) Crisis is upon us

In July 2016 I posted about a remarkable pattern of prices seen through Q2 across all regions of the NEM. Earlier this month I updated this analysis for Q2 2017 and noted how the results had become even more extreme (which was then picked up elsewhere). In my recent article, and at the conference, I suggested that this now appears to be a more systemic change in pricing patterns. As I noted at the conference, these patterns will pose significant challenges to

(a) the “buy low, sell high” arbitrage approach that would power battery storage, and

(b) the sheer number of hours involved (more than 50% of the half-hours above $100/MWh in TAS, VIC and SA through Q2 2017) making all methods of demand response more problematic.

I’ve also noted how we’re seeing this already have a significant toll on the large industrial energy users we serve as a valued part of our client base.

As noted to the audience, I’m more pessimistic than other speakers at the event had seemed to be that we’re close to a resolution.

2) Four types of actors in the drama

Through my presentation, I then walked through some examples of how different people (and “things”) seem to have been auditioning for the four roles in the emerging crisis (the Victim, the Means of Destruction, the Villain and the Saviour). In upcoming posts, I’ll be endeavouring to translate these thoughts (more fully formed) into discrete articles on WattClarity.

In an effort to forestall misdirected comments below, let me re-state my perspective that:

(a) The energy transition is occurring for a number of different reasons.

(b) it’s not the destination that has necessarily lead to the crisis upon us, it’s been the inadequate process we’ve all been following whilst striving to get there.

In terms of mitigating the “Crisis” in both price and supply what can be done to rectify the inadequecies of the current process?

Should existing coal fired stations be preserved until the process is improved and the alternative system in place and proven?

I visited the AEMO site today, and screenshotted what i saw. Over $300/MW in NSW! (25/07, 17:45) The other mainland states were not far behind! I certainly hope this does not become a trend! There didn’t seem to be any rhyme or reason for it. Generation figures appeared to be about normal?

The bottom line is, if governments leave critical infrastructure to the market then being free it will move in any direction. Mostly up to protect and reward investors.

The nuclear argument is now essential to the future of our electricity network as it appears ‘new coal’ is almost as unacceptable as nuclear.

It is unconscionable that the world should be turned inside out like this…but for Australia itself the potential for existential damage is of a magnitude that dwarfs that for all the other first world countries …because we have no alternatives after the Left kills fossil fuel.

Every other first world country has base load alternatives such as massive hydro and or nuclear and connectors to other countries to fall back on in the case of energy insecurity…Australia has none of that!

Australia will be ALONE…out on a dangerous limb as this RE juggernaut demands it commits suicide….the only country in the world being told to commit economic and social suicide !

For the amount of money the ANU’s 100% RE electrical system for Australia plan would cost….all of Australia’s coal and gas plants could be progressively replaced by HELE coal plants and any better versions to come…and there would still be money for the upgrading and/or replacement where necessary of the Australian grid.

There would still be a cut in emissions that’s demanded ….augmented by the elimination of the fugitive methane emissions from the CSG mining that would no longer be necessary.

Any Australian business people who are not deeply secretly invested in the RE juggernaut would have rocks in their heads if they let this insanity go one step further….especially as they should be au fait with the complete unsustainability of it all in the long-term with regard to EROI.

Unless of course they just don’t care about all that…they’re just in it to make their money quickly before it all hits the fan and Australia goes belly-up.