Some friends lost their car a couple of weeks ago.

Not in an absent-minded, Bo-Peep, “didn’t know where to find it” sort of way – but rather in a more dramatic “bang”, kaput sort of a way. Not an old car, by any means, and not a cheap one either. Seems that in the everyday busy-ness, they overlooked a scheduled car service – which turned out to be an expensive mistake.

This story is a very practical reminder of another core (but less recognised?) challenge that the NEM is facing currently – stemming from the current oversupply that could well get worse before it gets better (with more subsidised capacity being loaded in, and demand still declining).

Recently AGL published this working paper that talks about the risk of unintended interplay between the NEM’s energy-only market design and other policy decisions taken outside of the electricity market framework but significantly affecting the performance of the NEM. The AGL chairman also gave this presentation last week. Questions about whether the NEM will require capacity payments are increasingly being voiced in public, and private, by a range of people.

On the other side of the country, ironically, the WA government is canvassing options for reducing the higher cost of wholesale* electricity supply in the west – with one option being the transition to an energy-only market such as in the NEM.

* As our readers know, retail costs for electricity in the NEM have risen sharply in recent years. What some find harder to understand is that this has happened coincident with wholesale costs remaining steady for most of the past 15 years, declining more recently.

One risk with a capacity market is that any cost of oversupply might be shifted from generators (who bear the risk in the NEM) to customers (who ultimately bear the risk in WA) – something like how energy users in the NEM are bearing the cost of overcapacity in transmission and distribution networks currently.

In theory, the NEM (or any market) should be self-balancing, with investors responding to price signals to build new capacity, or retire capacity that’s not making an economic return. Ensuring the market structure is such that the right incentives are sent has been a challenge for market operators around the world since as early as 1997, and this enduring challenge has not been forgotten.

As Dylan, Keith (quoting Olivia) and others have noted, the NEM is affected by not only the National Electricity Objective, and the Rules under which it operates – but by other policies, such as QLD’s recently closed 13% gas scheme (though the RET Review is currently topic of the day for many).

Understandably, such voiced concerns have been interpreted by others as “the sky is falling” alarmism, and/or defensive play by incumbent thermal generators. I am grappling with the degree to which such concerns are real – and would be interested in your comments (online, or offline).

It seems to me that there are four different timeframes that need to be thought through to understand the interplay:

Period #1) Decisions being made today

It’s no surprise to know that every existing generator (coal, gas, hydro or wind) operating in the wholesale market has been hurting as a result of the oversupply.

Economists call it a “wealth transfer” but to people whose jobs are on the line I’m sure it feels more personally painful than those abstract words suggest. Just the same pain, but on the other side of the fence, as what has prompted the solar PV installers to mount their current grassroots campaign to save the RET.

This pain is affecting significant decisions being made today about operations, and maintenance:

1a) Operational changes

Due to the yawning gap between available supply and demand, capacity factors (i.e. percentage of output divided by installed capacity) at existing thermal plant have been declining.

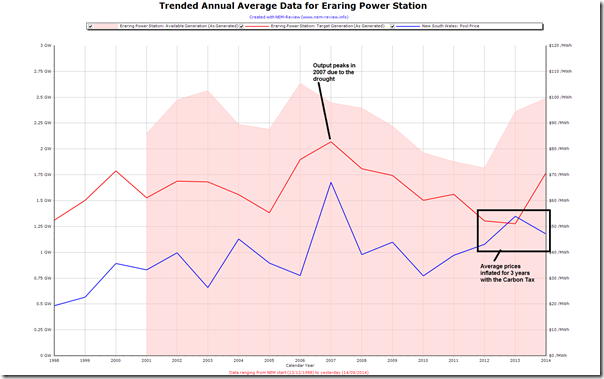

Take for instance this chart of Eraring Power Station, taken from our NEM-Review software:

From a high point in 2007, production levels trended down through to 2013 (before spiking back up in part-year 2014). What’s also the case is that average availability levels also declined.

Some interesting dates in the above are:

i. In 2011 Origin purchased the gentrader rights to Eraring’s output (availability still trending down).

ii. 1st July 2013 Origin announced the purchase of the physical asset, completing the second part of the privatisation (availability increases, followed by output).

1b) Maintenance changes

I think it was at the EUAA Queensland Energy Forum earlier this year that I heard Stanwell’s CEO (Richard van Breda) note that one of the reasons behind the temporary closure of two units at Tarong had been the deferral of a significant cost (I think it was about $20M) for an upcoming overhaul of one of the units. Putting the unit in cold-storage (now soon to be returned) was one way of deferring that cost until later.

EnergyAustralia as taken the same sort of temporary closure decision at Wallerawang, for instance, as it had before with a unit at Yallourn.

One take on AGL’s stated plans to invest more in maintenance work on Bayswater and Liddell is that a profit-constrained Macquarie Generation had deferred significant maintenance expense over recent years (at least in part because of uncertainty about its future). The same might be read into the Eraring chart above. Perhaps a similar thing is happening in Queensland with the possible privatisation of CS Energy and Stanwell – meaning any “not absolutely essential” expenditure is on hold.

If the oversupply continues to grow (a function of demand trajectory, and capacity additions and withdrawals) then it seems reasonable to assume that these types of decisions will continue, and may increase. Herein lies part of the concern.

Period #2) The effect of these decisions in the next couple years

A general rule of thumb is that base-load thermal power stations have design lives of 200,000 operating hours (so 25 years, assuming continuous operation at 90% availability).

A power station’s “design life” can be thought of as analogous to the warranty period that manufacturer’s issue for a car (though let’s be clear – it’s not exactly the same). Just as it is with a car, it is normal to assume that a power station will continue to run well beyond its design life. Just because a new wind farm reaches its (15-year?) design life does not mean that every single turbine is suddenly going to fall in a heap on the ground on Day +1. The same is true with thermal plant (as a plant ages, capital depreciation might decline whilst operations and maintenance cost increases).

In this sense, current commentary about how the NEM is relying on a “Dad’s Army” fleet of old clunkers is just a distraction.

When I departed Australia back in 1995 on my UQ ES Cornwall Scholarship, I left to study the way in which the emerging competitive market was changing the way power stations were managed – particularly because of questions about how high-cost components would be affected by a volatile spot price. Those interested in where I worked can see here.

Core to these concerns were the fact that effective management of long-life assets needed to rise above short-term perturbations in the industry in which they operate. Like the case of a missed service on a car, decisions taken today could have long-term, very expensive (and possibly systemic) repercussions.

Nearly 20 years later, we see that (in the NEM and elsewhere) there have not been systemic issues arising in generator operations emerging from the implementation of competitive markets for electricity. However, I noted how market operators have been keenly aware of this challenge since as early as 1997, and this helps them stay on top of the challenge. Awareness of a risk of a “bathtub curve” of generator reliability is always present.

However this same question has returned, due to policy objectives that have been layered on the top of the energy market framework from the outside – perhaps (some think) without adequate thought to the interplay between the two. A key difference with the prior occasion is now that (perhaps) the people focused on broader de-carbonisation don’t have the same core focus on security of supply as do those within the energy market.

In terms of de-carbonisation, it is one question to ask “how much, and how fast, and if at all?” (questions, as noted before, that we’re staying well away from).

It’s a quite separate question to ask “how to effectively manage implementation of such a policy?” to reduce the risk of adverse and unintended consequence. This is a question that – it seems – not as many people are really thinking through from a systems perspective.

2a) Examples of poor implementation

Each of our readers will be able to easily recall examples where government policy decisions have been very poorly implemented – at significant cost and pain.

Fresh from the recent inquiry, our readers on the right might point to Kevin Rudd’s insulation roll-out debacle as one example – whilst our readers on the left might point to the poorly implemented “Liberate Iraq” decision of Howard, Bush and Blair. There are plenty more…

2b) How poor implementation might manifest in the NEM

Within the thermal power stations that make up the back-bone of the NEM (and will do for at least another decade), creep and fatigue are two big failure modes. The rate of degradation due to creep and fatigue is a function of how many hours the plant has run, how hard, and how it has been maintained (a bit like a car, really, just a lot more expensive).

In a broad sense, it’s true that increased cycling of plant (particularly plant that was designed to run base-load) and skimping on maintenance expenditure would accelerate their rate of degradation. How rapid this actually is changing would take significant effort (and expense) to uncover – and no:

i. I’m not saying that they are all going to go kaput any day soon;

ii. Nor am I pitching to do that investigation.

As the forced outage rate of a fleet of plant increases, so does the risk that there will be multiple units offline at the same time resulting from seemingly independent failures at different plant – but where the failures might stem (in part) from common changes to operations and maintenance decisions, inspired by market dynamics and policy direction (and/or uncertainty).

This is how it might play out in the real world (please be clear, I’m not stating that the sky is falling, just that the risk of coincident outages is increasing).

In the modelling world (see prior comments about modelling here) it also has implications.

In modelling the dispatch of the market into the future, modellers need to assume power station parameters such as a forced outage rate (i.e. how often the plant will be unavailable due to unplanned issues, and for how long in each instance) – as they wrap these parameters in randomised monte-carlo simulations to reflect many scenarios of what might actually play out in the future, in terms of the interaction between a time-varying demand trace and a time-varying availability profile for each station.

Typically, backward looking (i.e. measured) forced outage rates are used to produce forward-looking models. Generally speaking, this is reasonable practice – in the absence of systemic change.

However, if power stations are seeing accelerated degradation rates, then these will feed into higher forced outage rates in the future. Not taking this into account risks undervaluing spare capacity that will be needed in the transition period (for instance – assuming that more plant can close than would be the case in reality).

Period #3) Transition years (decades?)

There is much uncertainty about what will happen in the NEM for the next decade or two. As many have noted, this uncertainty is killing (black & green) investor confidence and promoting the deferral of many an investment (and closure) decision.

One scenario might be that the RET remains intact (hence new capacity continues to load in), and that (aided by the “death spiral”) energy demand continues to decline. Perhaps with some future change of government, more comprehensive carbon policy returns.

Especially under a scenario like this, then the three possible changes need to be considered:

3a) Assets run into the ground, so failure rates rise?

In the scenario outlined above it seems quite likely that (given a current oversupply, and the likelihood that that will grow worse) generators will slash maintenance expenditure across the board. This would be especially the case if generators accept the certainty that policy will make their assets close. Assets (especially those owned by portfolio generators) could be run into the ground.

Forced outage rates could (not necessarily will) increase quite quickly, in relative terms, and create a degree of systemic risk (i.e. the tail end of the “bathtub curve“).

Ironically, should it happen, it would have the effect of reversing the gains in economic efficiency that were delivered decades ago through reforms such as:

i. The Neil Galwey years of the QEC (including an obsessive focus on raising plant availability); and

ii. Hilmer microeconomic reform, corporatisation and privatisation – leading to the formation of the NEM and a significant rise in plant availability across the board.

Also ironic, in such a scenario, is that plant heat rates (and so emissions intensities) would also suffer – for the interim period until the stations were closed.

In this way the coal fleet would progressively come to be viewed a bit like our old second car at home – we hardly drive it, so we skip on maintenance and take out minimal insurance – but we still won’t sell it (or junk it) as it’s worth more to us as an optional form of transport sitting at home, doing nothing 99% of the time. The key difference from this analogy is that:

i. If we need to use that second car and that’s the time that it does not work – well, then, we just catch a bus. No real harm done – maybe we just need to reschedule whatever we turn up late for.

ii. In the electricity market, however, on that fateful day when we need a few of these old clunkers to work and they do not – well, then, there’s an awful lot of people sitting in the dark (more than methods such as demand response can cater for – despite how efforts by ourselves and others to support it).

3b) Asset holidays, rather than retirements?

Due to high capital costs & long lead times in wholesale supply (including for renewable technologies), investment and retirement decisions are given significant consideration. Furthermore, iterative feedback mechanisms (such as the AEMO’s MT PASA and ESOO publication processes) provide a means by which generators can continue to track a forward-looking supply/demand balance status, and refine their plans accordingly.

The durability of the NEM over 16 years (through drought conditions and floods, and through numerous changes of government) also provides some indication of the inherent resilience of these arrangements.

However a question does arise about whether the dynamics are the same for asset retirements (required under this scenario) as it has been in the past for new developments?

I also wonder what effect a collective shift of thermal plant reliability might have with respect to the above. As portfolios grow larger, each portfolio acquires more options for how to deploy its capacity into the market – however this might be a curse, as well as a blessing.

With some assets on vacation, but ready to be brought back if conditions ever recovered, what effect does this have on forward prices – and hence ability to bank new projects? If spot prices are capped below levels required to deliver new renewable capacity does the pressure increase for the cost of RECs to rise above the current penalty price, in order to get new projects away?

Stanwell chose to temporarily close two units at Tarong, rather than permanently decommission them, as it provided the option to return them at some stage in the future (an option it is now taking in anticipation that gas prices will rise) – and because it deferred incurring decommissioning costs. Wallerawang/Tallawarra represents the same sort of fuel switching option for EnergyAustralia. A larger AGL could potentially look at Liddell as an optional asset, for instance.

At what point would this approach switch for existing generators, with the realisation that it would be better for the asset to be permanently decommissioned to remove that particular uncertainty for the market? If this change did occur, to what extent would it happen around the same time for different generators.

Is there a risk of disorderly asset retirements?

3c) Bidding patterns change, chasing calm cloudy weather?

Layered on top of the physical changes (above) could also be some significant changes in bidding behaviour at thermal power stations (and commercial behaviour more generally).

Generally speaking, a thermal power generator might currently bid in four discrete tranche groupings:

1. A volume of capacity (to minimum load, historically) below zero – indicating a desire to remain on overnight and hence not incur restart costs the next morning.

2. A volume of capacity (around SRMC) above which price the generator earns some contribution to meeting fixed cost.

3. Some volume of capacity (around LRMC) used to assist in lifting the price above LRMC at times of daily peak demand (it would hope).

4. Some volume of capacity at some opportunistic price (say above $10,000/MWh) to deliver a possibility of supernormal short-duration return, and balance the significant number of hours running at below LRMC.

It’s more complicated in reality but the above is a good place to start.

There are many problems with this generic approach in an oversupplied market – and especially in a market where the output of intermittent generation will (naturally) see-saw between extremes on frequencies independent of daily demand shape.

In terms of wind farm operation:

i. We have seen many instances where prices drop below zero (particularly in SA) when wind farm production exceeds local demand, hence flowing out of the region via the interconnects. As wind farm penetration continues to increase, it’s logical that the frequency and duration of low-priced events will increase – so long as no change is made to generators bidding below zero to “must run” (at some point, however, that might change).

ii. We have also seen (such as in these “back of the envelope” calculations) a surprising degree of correlation of wind farm output across SA, VIC, TAS and southern NSW. Perhaps spreading capacity further north will help to deliver some diversity that we’ve been promised (we certainly found many new wind farms in northern NSW waiting to be built in our “Power Supply Schematic”, but we have not looked at the data to show the extent to which this would be true).

What this means, from a capacity point of view, is that

i. Almost zero wind capacity can be relied on to meet peak demand

ii. Hence other capacity needs to be available to meet this peak – even if its opportunity to run is curtailed (at times) by wind.

From an energy market point of view as penetration increases, it means that there will be times when these other generators will gain good volumes, but an increasing number of times when volumes will be severely limited – hence a greater need to achieve higher unit revenues when they do run.

Naturally, solar PV output is also intermittent – though it would seem to be on a more regular cycle, and one more correlated with the underlying daily shape of Native Demand.

Historically, we have seen patterns of hydro behaviour – though this has tended to be on much longer cycles (e.g. over a year – with seasonal rainfall, and over a decade – with El Nino/La Nina). Such patterns (if viewing raw output data) have been polluted, somewhat, by perverse regulatory incentives such as:

i. Generating hard in one year (i.e. above baseline) and lean in the next (i.e. to recover storage) to generate additional RECs; and

ii. Generating hard in the carbon tax years to maximise the windfall profits.

In summary, it might be seen that controllable thermal plant output (during this transitional period) is likely to become increasingly dependent on the interaction between 4 different (less controllable, and semi-independent) fluctuating variables – demand, locational wind speeds, solar incidence, and rainfall. Hence, it seems logical that the thermal generators that remain will become increasingly sophisticated in terms of:

1. Timing their outages coincident with times of high renewable generation – hence timing their periods of availability with periods of low renewable generation; and

2. Changing bidding patterns away from the theoretical construct above to ensure that they can earn a reasonable return in a significantly more (and more random) limited number of dispatch intervals available to them.

Thermal generators will need to become much more sophisticated in this transitional period. In some ways, this might be similar to the approach seen in Queensland in summer 2012-13 and summer 2013-04, where generators used opportunities that presented themselves (on that occasion to do with transmission constraints, mixed with other factors) to deliver profitable outcomes. The AER termed that “disorderly bidding” though I’m pretty sure that the generators might just see it as “earning a return”.

How these uncertainties are priced into the financial market – well, that’s a probably the topic for another post, or two…

It’s implicit in the above that other potential renewable technologies (e.g. geothermal, or solar thermal) are at least a decade away, in terms of being able to be deployed at scale. The fact that solar and wind have been the two new renewable technologies adopted under the RET is existence proof that something would need to change for other technologies to be adopted. Battery storage remains a dark horse – though I’d not be placing all my eggs in a basket in betting that storage costs (being a different technology base) will follow Moore’s law (based on silicon usage) as has been the case with solar PV.

Hence, for decade or more when such a transition is underway, it seems reasonable to expect significant change in a number of areas.

Only a few years ago, the notion that “peak” and “off-peak” times would become anachronistic constructs would have seemed fanciful – however this is what we’re seeing already in some locations, due to the “duck curve”. Coupled with this, it seems likely that pricing patterns will also change – the price duration curve might look different from what we’ve accustomed for it to be, and the timing of high prices may not be as heavily dominated by when peak native demand times are (scheduled demand peaks are likely to be significantly shifted in any event).

Altogether, it could make for very “interesting” times indeed.

Period #4) The 100% Renewable dream*

At some indeterminate point in the future (under this particular scenario) we might arrive at the prescribed endpoint (assumed in this scenario) of a 100% renewable NEM.

Keeping in mind that it’s only a relatively small amount of the energy (i.e. average demand) that is consumed at a residential level in the NEM, it’s important to understand that the choices made in the near term, and the extent to which these are informed by really objective analysis, will help to dictate what state demand is in at the end of this journey. Energy costs to the large businesses that make our economy “energy intensive” mean a very different thing to mums and dads at home.

* Note that the inclusion of “dream” in the title is not meant to be read in a pejorative sense – indeed some might read it along the lines of MLK’s “I have a dream” vision. Rather, it is meant to indicate that all the advocates for that future really have, at present, is a dream – due to the shortage of real substantive planning on what steps would be needed for such a transition to work.

Please note that, as I write the above, I am very consciously aware that I don’t have the answers to this dilemma – but, then, I don’t really see anyone who currently does, anywhere around the world.

And one final reminder, before opening to comments – we remain technology agnostic, and will not get bogged down in policy-decisions about whether, or not, a 100% renewable NEM is a laudable objective, or the best focus for Australia’s investment dollars.

The point in posting this article is to say that – if the policy decision is made to move in this direction – then the very least we owe future generations is that we actually think it through and implement it properly …

Thanks for a really helpful explanation of the issues underpinning some of the warnings we’ve been hearing about supply security. The slow build-up of a systemic security risk resulting from skimpy maintenance is pretty convincing. And to me, as a representative of the “people focused on broader decarbonisation” it suggests that there’s a strong security argument for a clear policy driver of orderly plant retirement. Not that I’m clear on what that should look like, yet. But would be interested in your thoughts on how such a policy could be designed to best address security risks.

Thanks Olivia

Will return to your question, as time permits

Paul