- Background

- Sequence of Events

It appears that we spoke too soon when we mentioned on the 22nd July that winter 2008 had been relatively uneventful.

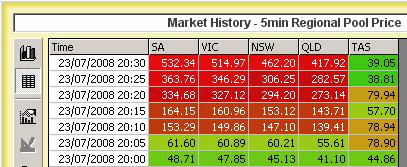

Just over 24 hours from making these comments, we saw prices jump sky-high in the mainland regions, and go the other way (to the negative price cap) in Tasmania.

The following table provides a summary of what we have been able to ascertain as the sequence of events in the NEM over the evening of 23rd July.

Thank-you to those traders we met with on 24th July who explained some of these events to us in more detail.

| Sequence of events on Wednesday 23rd July |

|---|

|

Prior to the events of the evening of 23rd July, one of the 3 x 500kV transmission lines linking the Loy Yang power stations with the Hazelwood power station was out of service for planned maintenance. The HWTS – LYPS No2 500Kv Line in the Vic region was scheduled to be returned to service at 15:00 on Thursday 24th July 2008. |

|

At 17:05, whole of NEM demand reached 30,000MW for the evening. Pricing is subdued. |

|

By 17:20, whole of NEM demand had grown to 30,715MW. |

|

Five minutes later (17:25), dispatch demand was 31,035MW |

|

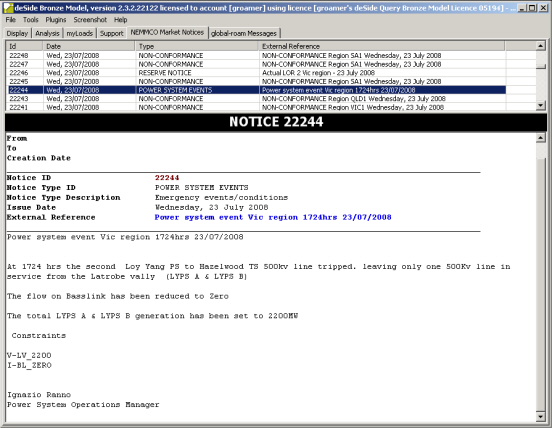

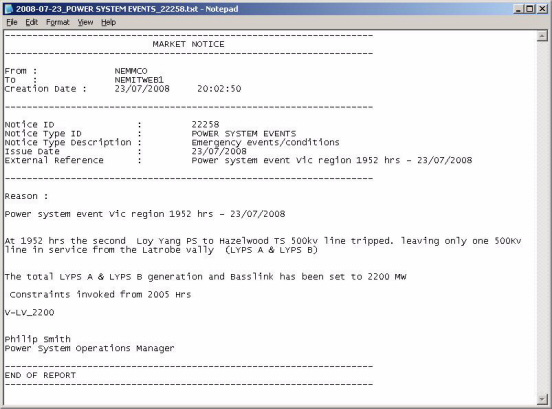

At 17:24 the second line between Loy Yang and Hazelwood (in the Latrobe Valley) tripped – see the market notice copied above. |

|

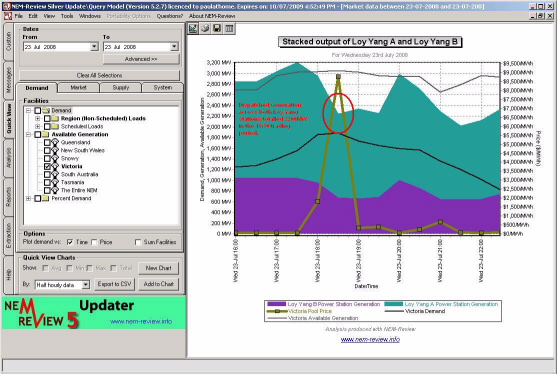

As a result of this, the total output of the two stations (Loy Yang A and Loy Yang B) was reduced to 2,200MW (the capacity over the single remaining transmission line). In the summary included from NEM-Review above, we can see how the average dispatched output for the 18:30 trading (30-minute) period had dropped to that level. We can see that the level of output in the 18:00 trading interval had dropped, but only to 3,000MW. Because NEM-Review only facilitates access to trading data (and not the 5-minute dispatch data) it is not possible to confirm that this was just because the dispatched output was progressively trending down to 2,200MW (and what the rate of decline was). |

|

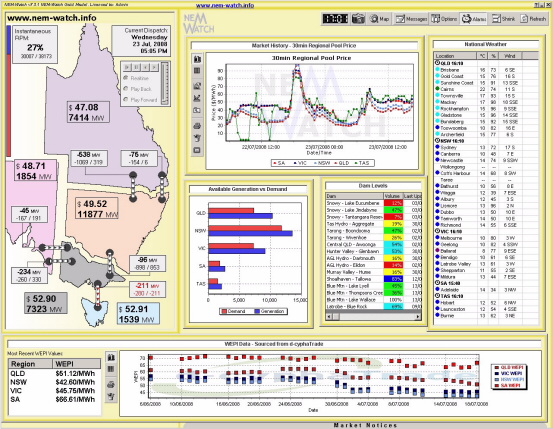

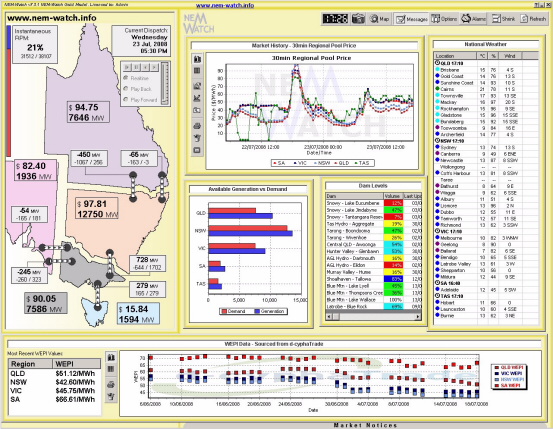

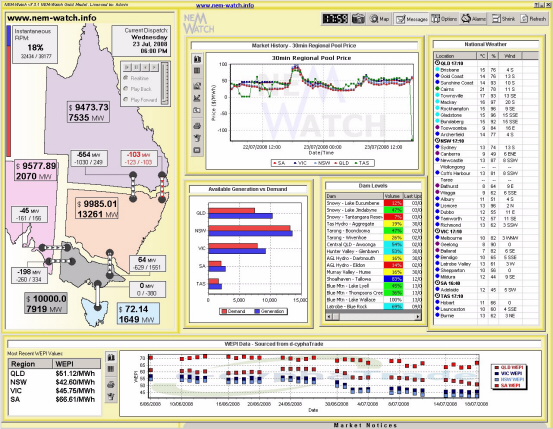

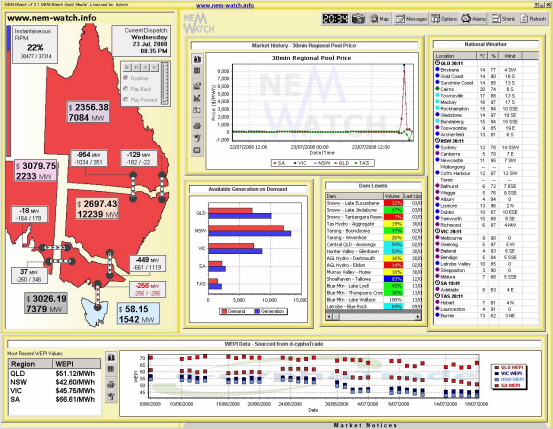

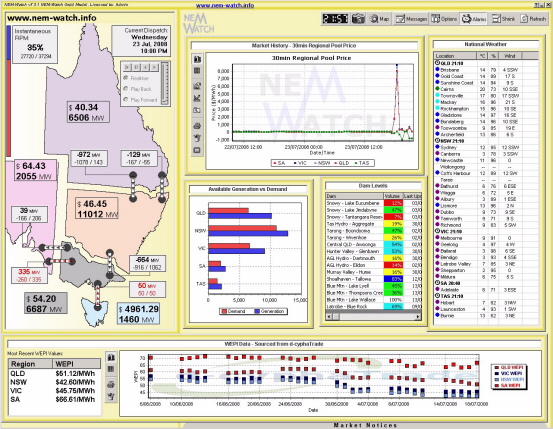

By 17:30, the demand had grown another 500MW across the whole of the NEM. Prices were still modest (but climbing), as can be seen in the snapshot from NEM-Watch. |

|

Over the next 20 minutes (to 17:50), demand grew another 900MW (to 32,443MW). We have not checked in detail, but believe that this might be near the maximum demand experienced this winter (though still 1,000MW lower than the peak experienced in winter 2007). |

|

At 17:55, demand had increased marginally (by only 100MW) but prices had jumped to be in the $200-$300/MWh range across the mainland NEM regions. |

|

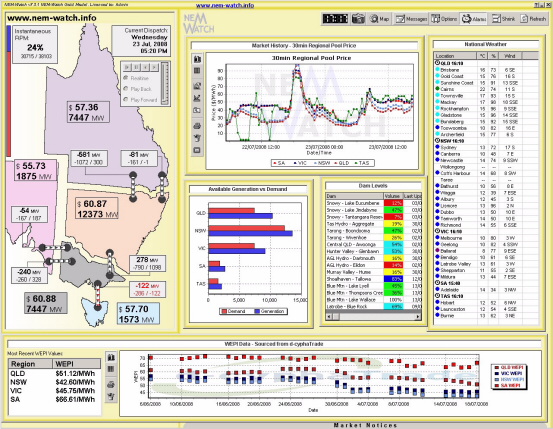

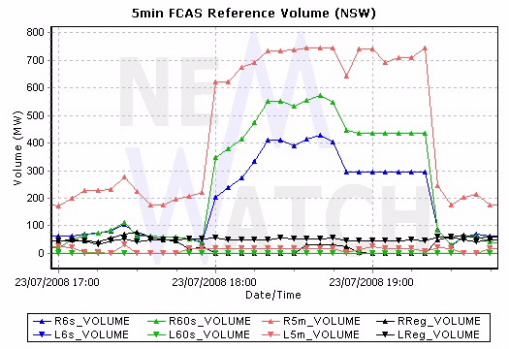

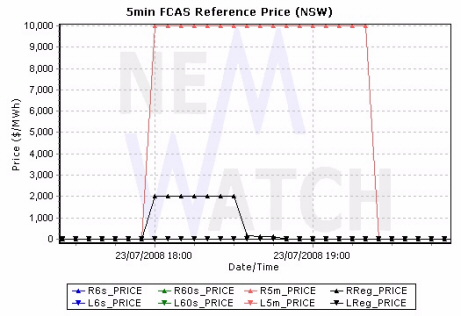

Because the trip of the remaining 500kV transmission line (carrying 2,200MW of generation) became the largest single contingency, NEMMCO increased its procurement of FCAS raise commodities, as shown in the NEM-Watch chart above. This forced FCAS prices to rise to VOLL, as shown below.

|

|

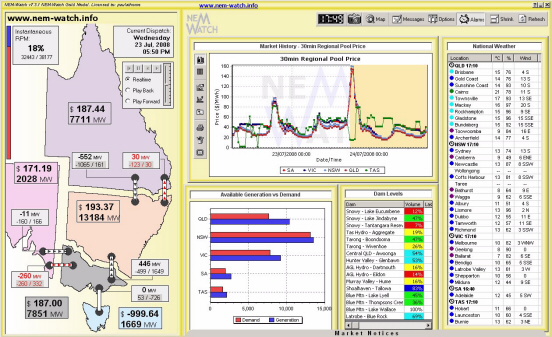

Coincidentally, because there was almost 2,000MW of available capacity notionally removed from the energy market in order to provide these raise services, the dispatch (5-minute) prices for energy hit VOLL in Victoria at 18:00, and not far from that in NSW, SA and QLD. Tasmanian prices separated from the mainland prices as NEMMCO constrained Basslink so that it could not export into Victoria (because the transmission capacity from the Latrobe Valley was not capable of carrying the flow). Prices remained above $1000/MWh until 18:35:

It is presumed (though there was no market notice issued to confirm) that the second transmission line had been reconnected by this time – though |

|

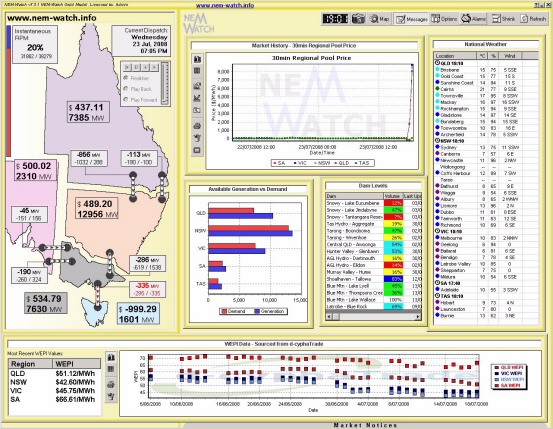

At 19:05, dispatch prices jumped slightly (from the $200’s to $500’s). At this point in time (from 18:55), NEMMCO had constrained Basslink such that it had to export surplus generation in the Latrobe Valley into Tasmania, driving Tasmanian prices towards the lower cap. |

|

Prices gradually recovered, as shown here:

|

|

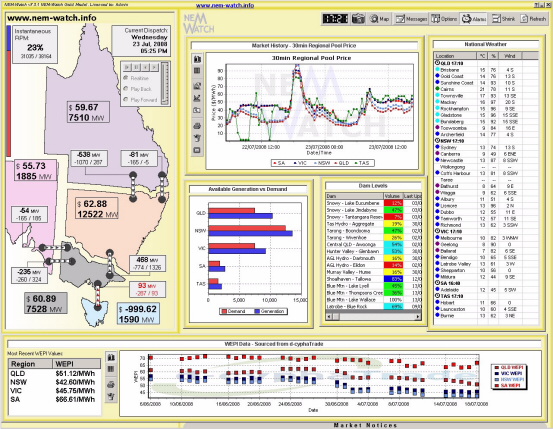

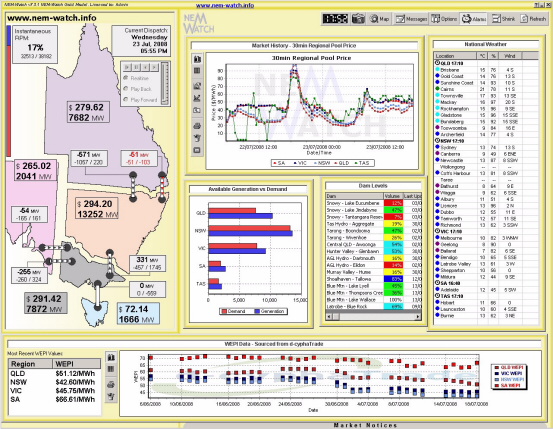

At 19:52, the second Loy Yang to Hazelwood 500kV line tripped, for what appears to be the second time. NEMMCO invoked a constraint equation limiting the flow on the transmission line into the Latrobe Valley (effective from the 20:05 dispatch interval). Prices then began to climb again, as shown here:

|

|

At 20:35, prices jumped again on the mainland. At this time, Basslink was still forced to flow south, and we can also see that FCAS prices reached the VOLL price cap of $10,000/MWh (remaining there until 21:05). |

|

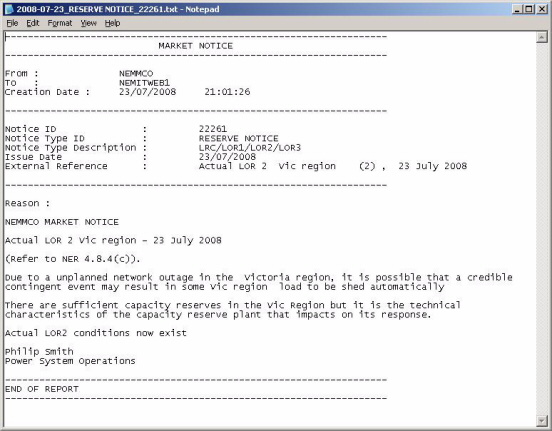

At 21:01 NEMMCO issued a LOR2 notice (meaning shortage of required reserves) for the Victorian region (the LOR condition existed between 19:52 to 21: 56). At 21:35, FCAS prices jumped up to VOLL for the third time (remaining there until 22:10). |

|

At 22:00, prices in Tasmania spiked – we did not investigate this spike. |

Be the first to comment on "VOLL Pricing on 23rd July 2008"